Question: please answer both questions Question Help Assume Gillette Corporation will pay an annual dividend of $0.63 one year from now. Analysts expect this dividend to

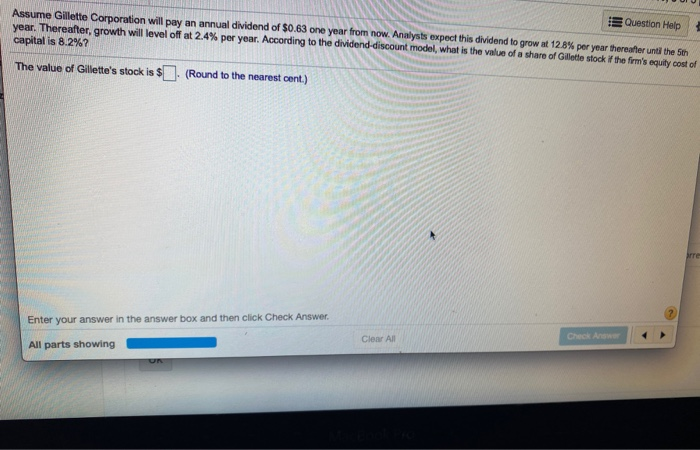

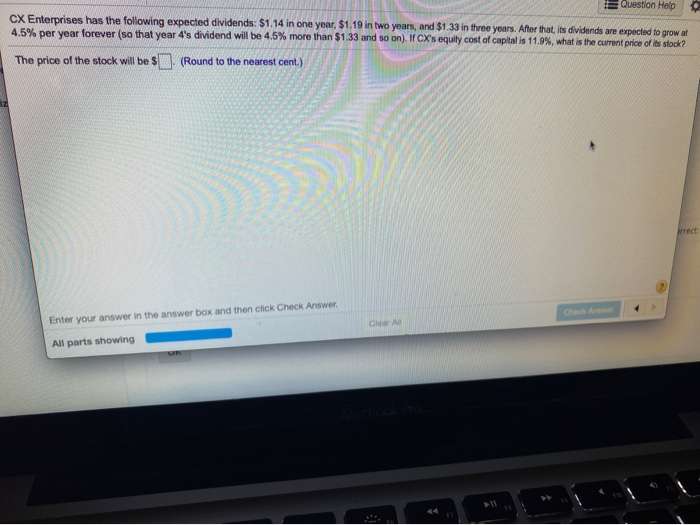

Question Help Assume Gillette Corporation will pay an annual dividend of $0.63 one year from now. Analysts expect this dividend to grow at 12.8% per year thereafter until the sth year. Thereafter, growth will level off at 2.4% per year. According to the dividend-discount model, what is the value of a share of Gillette stock the firm's equity cost of capital is 8.2%? The value of Gillette's stock is $ 1(Round to the nearest cent.) Enter your answer in the answer box and then click Check Answer. Clear All Check AS All parts showing CX Enterprises has the following expected dividends: $1.14 in one year $1.19 in two years, and $1.33 in three years. After that, its dividends are expected to grow 4.5% per year forever (so that year 4's dividend will be 4.5% more than $1.33 and so on). If CX sequity cost of capital is 11,9%, what is the current price of its stock? The price of the stock will be $ . (Round to the nearest cent.) Enter your answer in the answer box and then click Check Answer All parts showing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts