Question: please answer both questions S06-01 Present Value and Multiple Cash Flows [LO1] Mendez Company has identified an investment project with the following cash flows. a.

![[LO1] Mendez Company has identified an investment project with the following cash](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f6cbcf57c91_06266f6cbceea523.jpg)

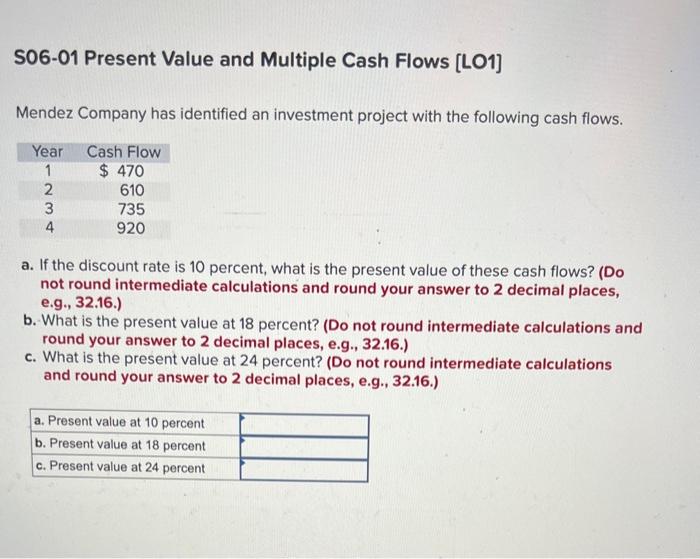

S06-01 Present Value and Multiple Cash Flows [LO1] Mendez Company has identified an investment project with the following cash flows. a. If the discount rate is 10 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the present value at 18 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the present value at 24 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) S06-04 Calculating Annuity Present Value [LO1] An investment offers $3,850 per year for 15 years, with the first payment occurring one year from now. a. If the required return is 6 percent, what is the value of the investment? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What would the value be if the payments occurred for 40 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What would the value be if the payments occurred for 75 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. What would the value be if the payments occurred forever? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts