Question: Please answer both questions. Thank you. Question 9 0.25 pts Realizing that bacon toothpaste probably wasn't the best invention, Mr. Bacon's business (Bacon Co.) developed

Please answer both questions. Thank you.

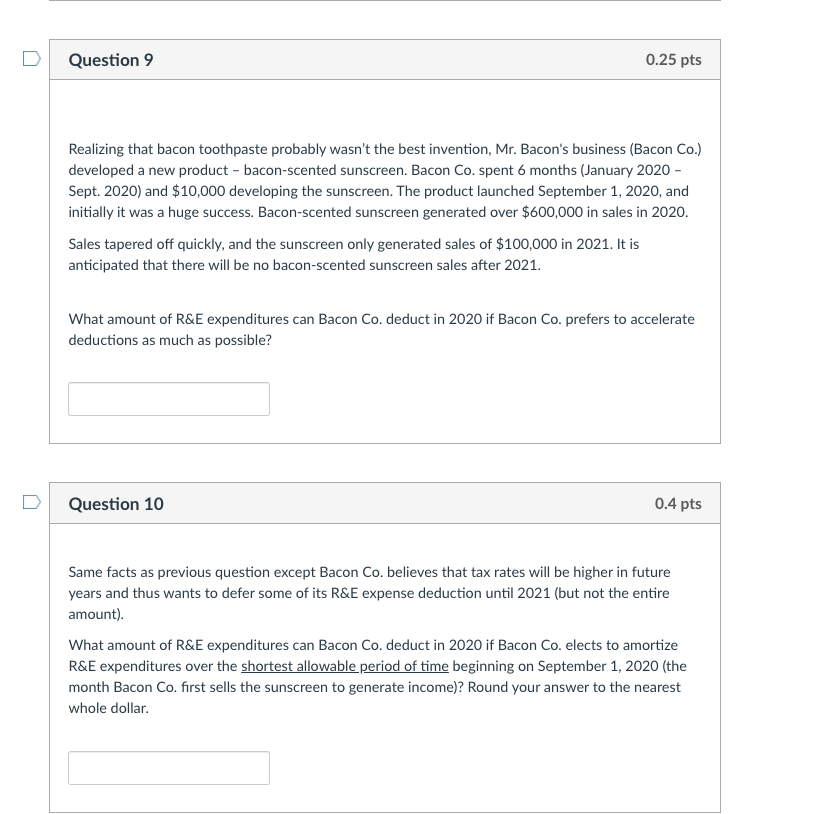

Question 9 0.25 pts Realizing that bacon toothpaste probably wasn't the best invention, Mr. Bacon's business (Bacon Co.) developed a new product - bacon-scented sunscreen. Bacon Co. spent 6 months (January 2020 - Sept. 2020) and $10,000 developing the sunscreen. The product launched September 1, 2020, and initially it was a huge success. Bacon-scented sunscreen generated over $600,000 in sales in 2020. Sales tapered off quickly, and the sunscreen only generated sales of $100,000 in 2021. It is anticipated that there will be no bacon-scented sunscreen sales after 2021. What amount of R&E expenditures can Bacon Co. deduct in 2020 if Bacon Co. prefers to accelerate deductions as much as possible? Question 10 0.4 pts Same facts as previous question except Bacon Co. believes that tax rates will be higher in future years and thus wants to defer some of its R&E expense deduction until 2021 (but not the entire amount). What amount of R&E expenditures can Bacon Co. deduct in 2020 if Bacon Co. elects to amortize R&E expenditures over the shortest allowable period of time beginning on September 1, 2020 (the month Bacon Co. first sells the sunscreen to generate income)? Round your answer to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts