Question: please answer both questions . Thanks :) 2. Hex Corporation showed the following amounts in the equity section of its balance sheet at January 1,

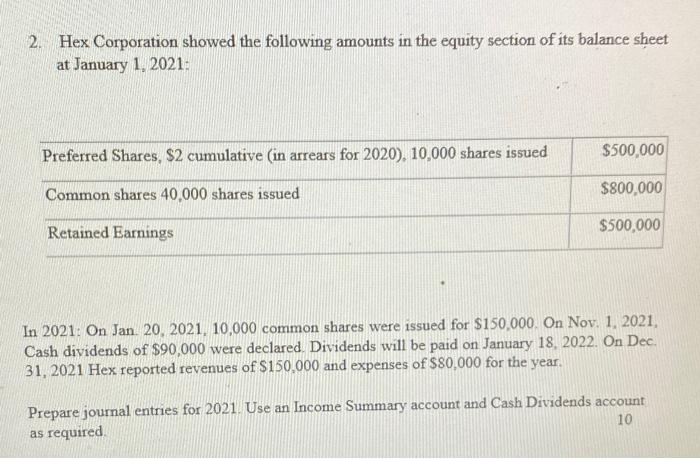

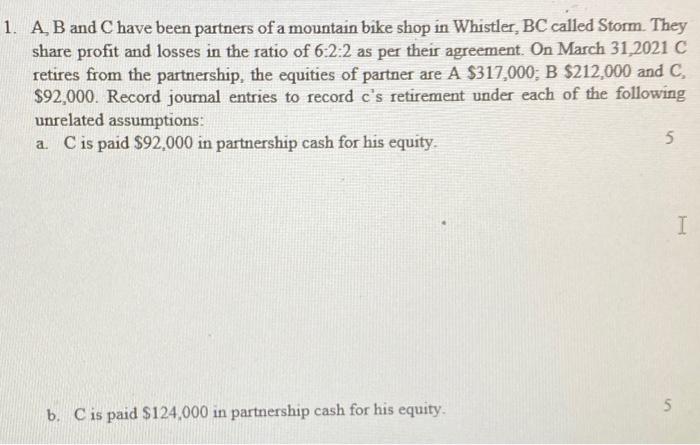

2. Hex Corporation showed the following amounts in the equity section of its balance sheet at January 1, 2021: Preferred Shares, $2 cumulative (in arrears for 2020). 10,000 shares issued $500,000 Common shares 40.000 shares issued $800,000 Retained Earnings $500,000 In 2021: On Jan 20, 2021, 10,000 common shares were issued for $150,000. On Nov. 1. 2021, Cash dividends of $90,000 were declared Dividends will be paid on January 18, 2022. On Dec. 31, 2021 Hex reported revenues of $150,000 and expenses of $80,000 for the year. Prepare journal entries for 2021 Use an Income Summary account and Cash Dividends account as required 10 1. A B and Chave been partners of a mountain bike shop in Whistler, BC called Storm. They share profit and losses in the ratio of 6:2:2 as per their agreement. On March 31,2021 C retires from the partnership, the equities of partner are A $317,000; B $212,000 and C, $92,000. Record journal entries to record c's retirement under each of the following unrelated assumptions: a C is paid $92,000 in partnership cash for his equity. 5 I S b. C is paid $124,000 in partnership cash for his equity b. C is paid $124,000 in partnership cash for his equity. c. C is paid $76,000 in partnership cash for his equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts