Question: Please answer both questions, thanks. Sanger Inc. is considering a project that has the following cash flows: Year 0-$1,050, Year 1 $450, Year 2 $460,

Please answer both questions, thanks.

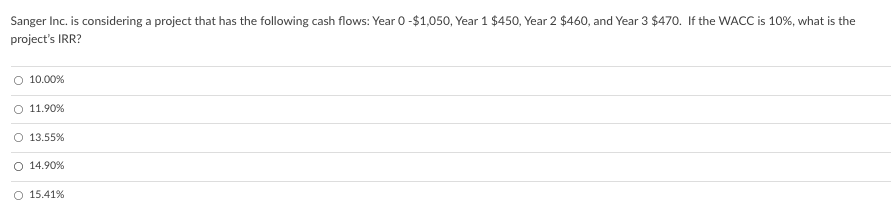

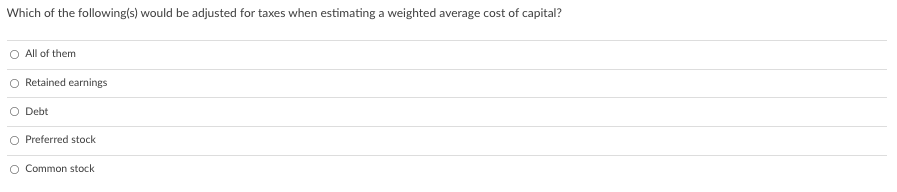

Sanger Inc. is considering a project that has the following cash flows: Year 0-$1,050, Year 1 $450, Year 2 $460, and Year 3 $470. If the WACC is 10%, what is the project's IRR? 10.00% O 11.90% O 13.55% O 14.90% O 15.41% Which of the following(s) would be adjusted for taxes when estimating a weighted average cost of capital? O All of them Retained earnings O Debt O Preferred stock Common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts