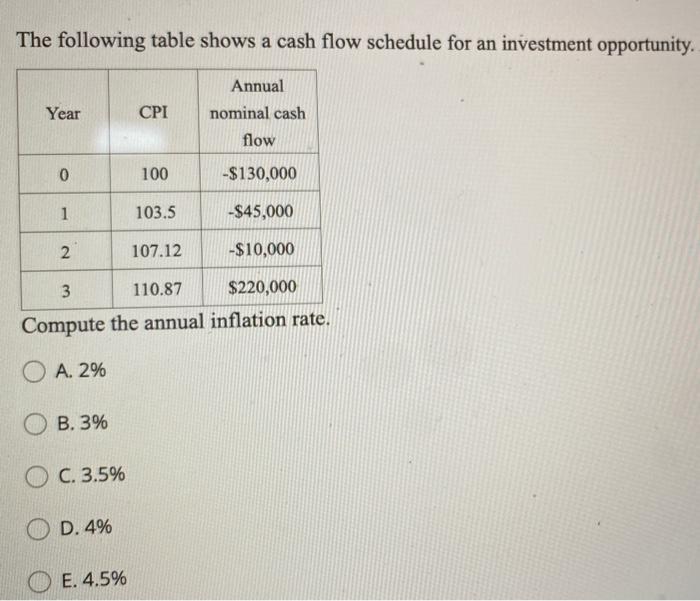

Question: please answer both questions. the second picture is a follow up to the first one. please show all steps too thank you The following table

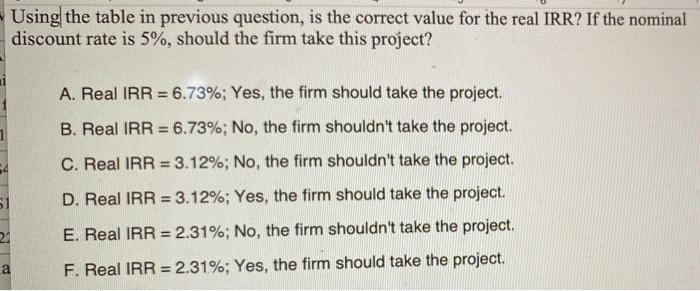

The following table shows a cash flow schedule for an investment opportunity. Year CPI Annual nominal cash flow O 100 -$130,000 1 103.5 -$45,000 2 107.12 -$10,000 3 110.87 $220,000 Compute the annual inflation rate. O A. 2% O B.3% O C. 3.5% D.4% E. 4.5% Using the table in previous question, is the correct value for the real IRR? If the nominal discount rate is 5%, should the firm take this project? ai A. Real IRR = 6.73%; Yes, the firm should take the project. 1 B. Real IRR = 6.73%; No, the firm shouldn't take the project. C. Real IRR = 3.12%; No, the firm shouldn't take the project. 51 D. Real IRR = 3.12%; Yes, the firm should take the project. E. Real IRR = 2.31%; No, the firm shouldn't take the project. a F. Real IRR = 2.31%; Yes, the firm should take the project. The following table shows a cash flow schedule for an investment opportunity. Year CPI Annual nominal cash flow O 100 -$130,000 1 103.5 -$45,000 2 107.12 -$10,000 3 110.87 $220,000 Compute the annual inflation rate. O A. 2% O B.3% O C. 3.5% D.4% E. 4.5% Using the table in previous question, is the correct value for the real IRR? If the nominal discount rate is 5%, should the firm take this project? ai A. Real IRR = 6.73%; Yes, the firm should take the project. 1 B. Real IRR = 6.73%; No, the firm shouldn't take the project. C. Real IRR = 3.12%; No, the firm shouldn't take the project. 51 D. Real IRR = 3.12%; Yes, the firm should take the project. E. Real IRR = 2.31%; No, the firm shouldn't take the project. a F. Real IRR = 2.31%; Yes, the firm should take the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts