Question: please answer both questions they go together, Thank you!!! Question 24 (1 point) Calls A and B have an exercise price of $60. The current

please answer both questions they go together, Thank you!!!

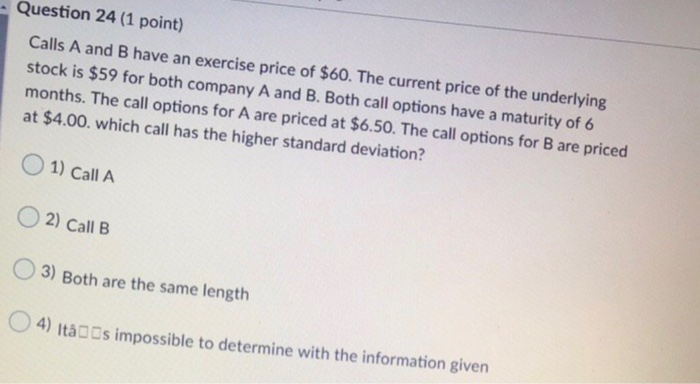

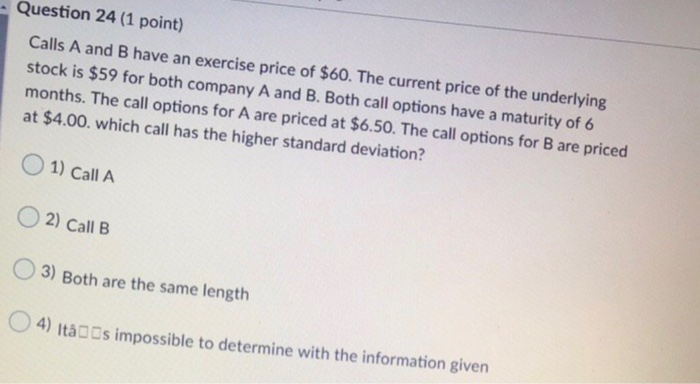

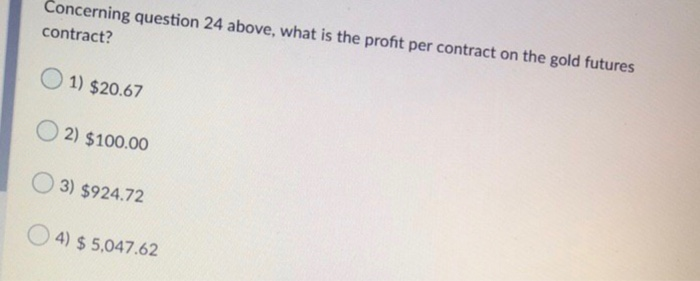

Question 24 (1 point) Calls A and B have an exercise price of $60. The current price of the underlying stock is $59 for both company A and B. Both call options have a maturity of 6 months. The call options for A are priced at $6.50. The call options for B are priced at $4.00. which call has the higher standard deviation? 1) Call A O2) Call B 3) Both are the same length 4) Its impossible to determine with the information given Concerning question 24 above, what is the profit per contract on the gold futures contract? O 1) $20.67 O2) $100.00 O3) $924.72 4) $ 5,047.62

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock