Question: please answer both Rufus is a one-quarter partner in the Adventure partnership. On January 1 of the current year, Adventure distributes $13,000 cash to Rufus

please answer both

please answer both

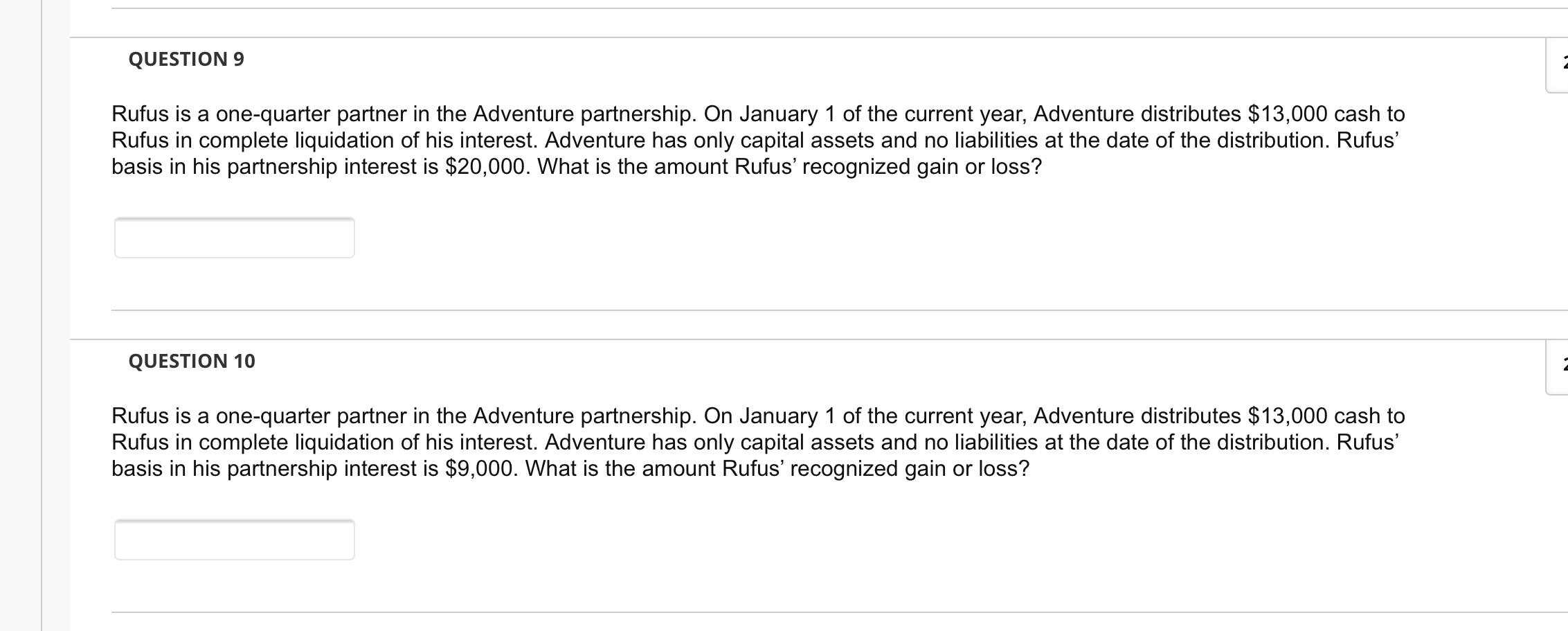

Rufus is a one-quarter partner in the Adventure partnership. On January 1 of the current year, Adventure distributes $13,000 cash to Rufus in complete liquidation of his interest. Adventure has only capital assets and no liabilities at the date of the distribution. Rufus' basis in his partnership interest is $20,000. What is the amount Rufus' recognized gain or loss? QUESTION 10 Rufus is a one-quarter partner in the Adventure partnership. On January 1 of the current year, Adventure distributes $13,000 cash to Rufus in complete liquidation of his interest. Adventure has only capital assets and no liabilities at the date of the distribution. Rufus' basis in his partnership interest is $9,000. What is the amount Rufus' recognized gain or loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts