Question: Please answer both thank you Dover Global Solutions, Inc. has the following balance sheet. The market value of the firm's bonds is equal to their

Please answer both thank you

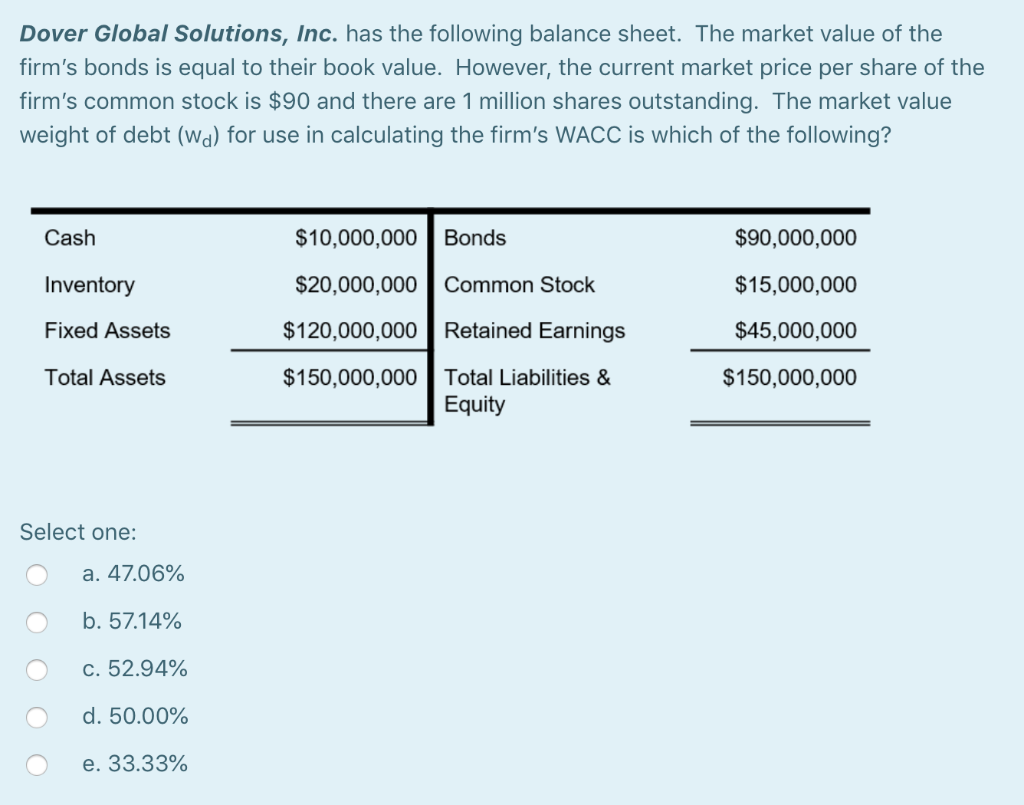

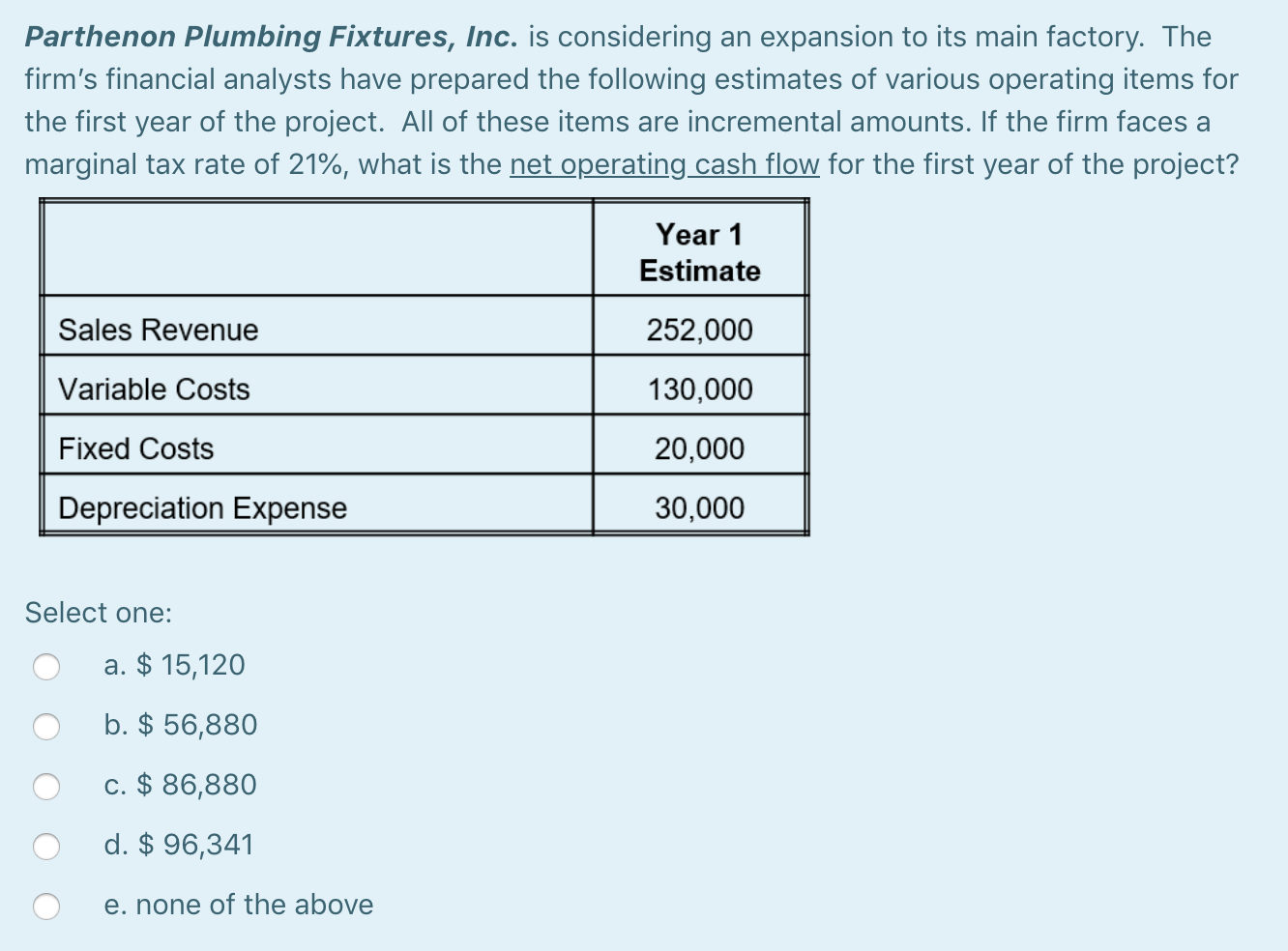

Dover Global Solutions, Inc. has the following balance sheet. The market value of the firm's bonds is equal to their book value. However, the current market price per share of the firm's common stock is $90 and there are 1 million shares outstanding. The market value weight of debt (wa) for use in calculating the firm's WACC is which of the following? Cash $10,000,000 Bonds $90,000,000 $15,000,000 Inventory $20,000,000 Common Stock Fixed Assets $120,000,000 Retained Earnings $45,000,000 Total Assets $150,000,000 $150,000,000 Total Liabilities & Equity Select one: a. 47.06% b. 57.14% c. 52.94% d. 50.00% e. 33.33% Parthenon Plumbing Fixtures, Inc. is considering an expansion to its main factory. The firm's financial analysts have prepared the following estimates of various operating items for the first year of the project. All of these items are incremental amounts. If the firm faces a marginal tax rate of 21%, what is the net operating cash flow for the first year of the project? Year 1 Estimate Sales Revenue 252,000 Variable Costs 130,000 Fixed Costs 20,000 Depreciation Expense 30,000 Select one: a. $ 15,120 b. $ 56,880 c. $ 86,880 d. $ 96,341 e. none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts