Question: please answer both thank you Sharpe Table, Inc. is considering a modification to the cutlery assembly line in its main plant in Mansfield, Ohio. The

please answer both thank you

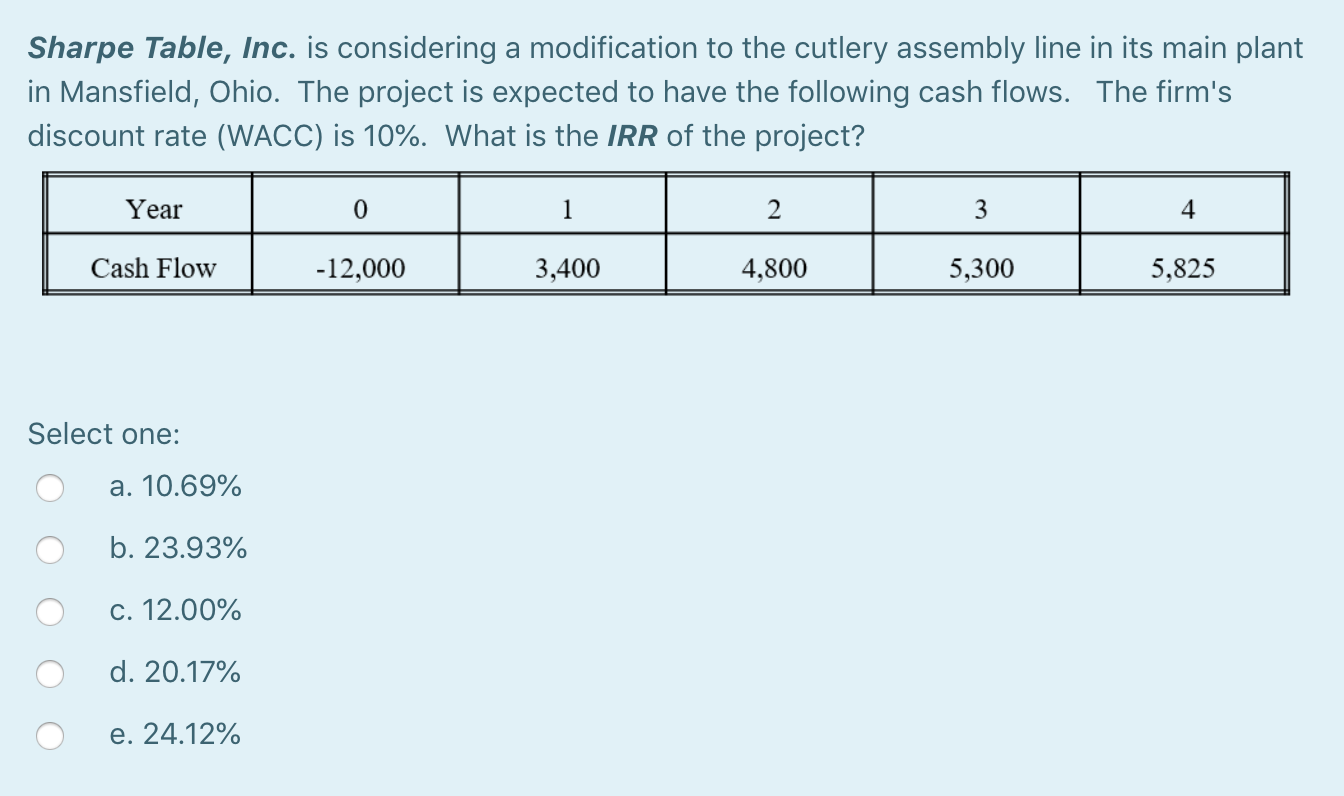

Sharpe Table, Inc. is considering a modification to the cutlery assembly line in its main plant in Mansfield, Ohio. The project is expected to have the following cash flows. The firm's discount rate (WACC) is 10%. What is the IRR of the project? Year 0 1 2 3 4 Cash Flow -12,000 3,400 4,800 5,300 5,825 Select one: a. 10.69% b. 23.93% c. 12.00% d. 20.17% e. 24.12% The earnings and dividends of Chang Enterprises, Inc. are expected to grow at 3% per year for the foreseeable future. The last annual dividend (Dt=0) was $4.00. The firm's marginal tax rate is 21%. The firm's investment bankers believe that new shares of common stock could be sold for $30 per share, but would charge flotation cost of 4%. Based on this information, what is your best estimate of the firm's cost of funding from new common stock? Select one: a. 20.17% b. 19.67% c. 14.31% d. 21.39% e. 13.33%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts