Question: please answer both the que 35 and 36. thank you Question 35 (1 point) Listen Three common measures related to risk are: a) Beta, standard

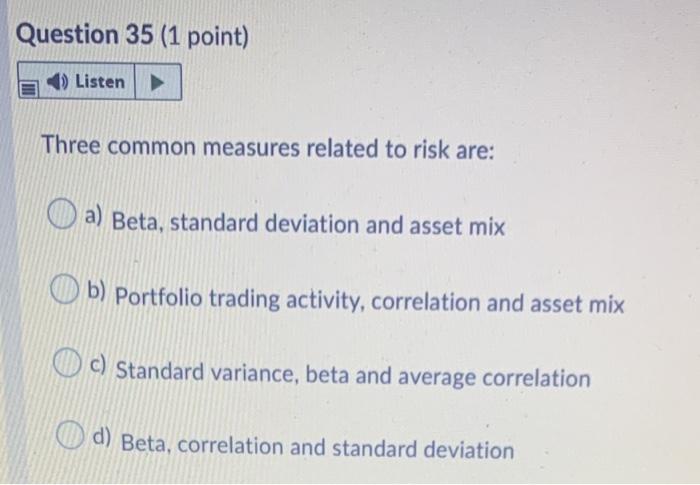

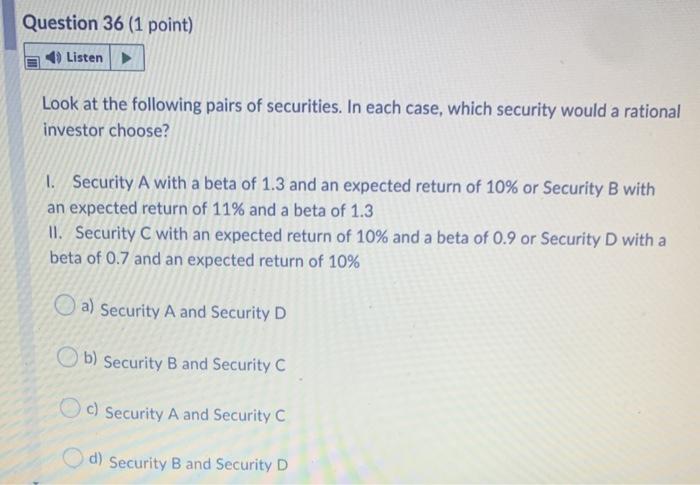

Question 35 (1 point) Listen Three common measures related to risk are: a) Beta, standard deviation and asset mix b) Portfolio trading activity, correlation and asset mix c) Standard variance, beta and average correlation d) Beta, correlation and standard deviation Question 36 (1 point) Listen Look at the following pairs of securities. In each case, which security would a rational investor choose? 1. Security A with a beta of 1.3 and an expected return of 10% or Security B with an expected return of 11% and a beta of 1.3 II. Security C with an expected return of 10% and a beta of 0.9 or Security D with a beta of 0.7 and an expected return of 10% a) Security A and Security D b) Security B and Security C c) Security A and Security C d) Security B and Security D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts