Question: Please answer both the questions Week 7 Question 2 (10 marks) Based on the information provided below, prepare appropriate consolidation journal entries for possible account

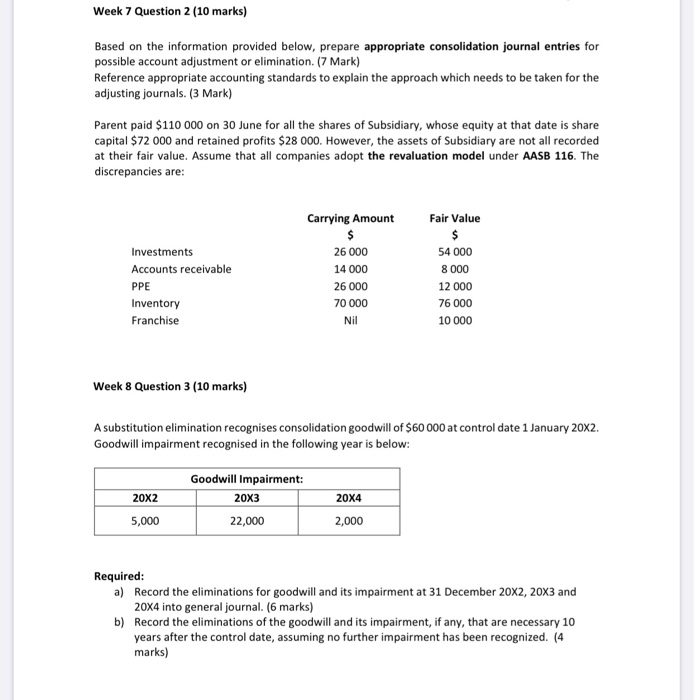

Week 7 Question 2 (10 marks) Based on the information provided below, prepare appropriate consolidation journal entries for possible account adjustment or elimination. (7 Mark) Reference appropriate accounting standards to explain the approach which needs to be taken for the adjusting journals. (3 Mark) Parent paid $110 000 on 30 June for all the shares of Subsidiary, whose equity at that date is share capital $72 000 and retained profits $28 000. However, the assets of Subsidiary are not all recorded at their fair value. Assume that all companies adopt the revaluation model under AASB 116. The discrepancies are: Fair Value $ Investments Accounts receivable PPE Inventory Franchise Carrying Amount $ 26 000 14 000 26 000 70 000 Nil 54 000 8 000 12 000 76 000 10 000 Week 8 Question 3 (10 marks) A substitution elimination recognises consolidation goodwill of $60 000 at control date 1 January 20x2. Goodwill impairment recognised in the following year is below: 20x2 5,000 Goodwill Impairment: 20x3 22,000 20x4 2,000 Required: a) Record the eliminations for goodwill and its impairment at 31 December 20x2,20x3 and 20x4 into general journal. (6 marks) b) Record the eliminations of the goodwill and its impairment, if any, that are necessary 10 years after the control date, assuming no further impairment has been recognized. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts