Question: please answer both these questions and show your work Question 1: You are trying to determine the Equity Beta (e) of a privately held company,

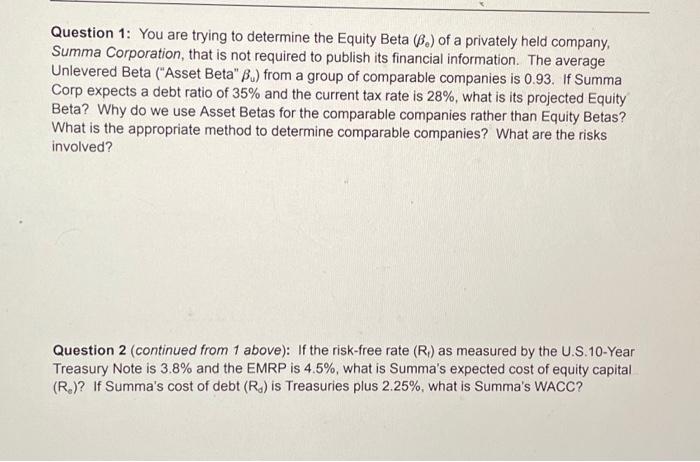

Question 1: You are trying to determine the Equity Beta (e) of a privately held company, Summa Corporation, that is not required to publish its financial information. The average Unlevered Beta ("Asset Beta" u ) from a group of comparable companies is 0.93 . If Summa Corp expects a debt ratio of 35% and the current tax rate is 28%, what is its projected Equity Beta? Why do we use Asset Betas for the comparable companies rather than Equity Betas? What is the appropriate method to determine comparable companies? What are the risks involved? Question 2 (continued from 1 above): If the risk-free rate (Rf) as measured by the U.S.10-Year Treasury Note is 3.8% and the EMRP is 4.5%, what is Summa's expected cost of equity capital (Re) ? If Summa's cost of debt (Rf) is Treasuries plus 2.25%, what is Summa's WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts