Question: PLEASE ANSWER BOTH THIS IS MY LAST QUESTION PLEASEEEEE!!!! 1. The Regal Cycle Company manufactures three types of bicyclesa dirt bike, a mountain bike, and

| Total | Dirt Bikes | Mountain Bikes | Racing Bikes | |

|---|---|---|---|---|

| Sales | $ 927,000 | $ 266,000 | $ 403,000 | $ 258,000 |

| Variable manufacturing and selling expenses | 465,000 | 112,000 | 200,000 | 153,000 |

| Contribution margin | 462,000 | 154,000 | 203,000 | 105,000 |

| Fixed expenses: | ||||

| Advertising, traceable | 69,300 | 8,200 | 40,900 | 20,200 |

| Depreciation of special equipment | 43,500 | 20,900 | 7,300 | 15,300 |

| Salaries of product-line managers | 115,300 | 40,800 | 38,900 | 35,600 |

| Allocated common fixed expenses* | 185,400 | 53,200 | 80,600 | 51,600 |

| Total fixed expenses | 413,500 | 123,100 | 167,700 | 122,700 |

| Net operating income (loss) | $ 48,500 | $ 30,900 | $ 35,300 | $ (17,700) |

*Allocated on the basis of sales dollars.

Management is concerned about the continued losses shown by the racing bikes and wants a recommendation as to whether or not the line should be discontinued. The special equipment used to produce racing bikes has no resale value and does not wear out.

Required:

1. What is the financial advantage (disadvantage) per quarter of discontinuing the Racing Bikes?2. Should the production and sale of racing bikes be discontinued?

3. Prepare a properly formatted segmented income statement that would be more useful to management in assessing the long-run profitability of the various product lines.

| Cost of equipment needed | $ 150,000 |

|---|---|

| Working capital needed | $ 64,000 |

| Overhaul of the equipment in two years | $ 10,000 |

| Salvage value of the equipment in four years | $ 14,000 |

| Annual revenues and costs: | |

| Sales revenues | $ 290,000 |

| Variable expenses | $ 140,000 |

| Fixed out-of-pocket operating costs | $ 74,000 |

When the project concludes in four years the working capital will be released for investment elsewhere within the company.

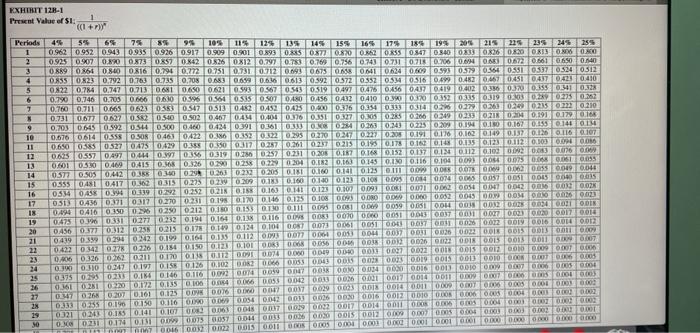

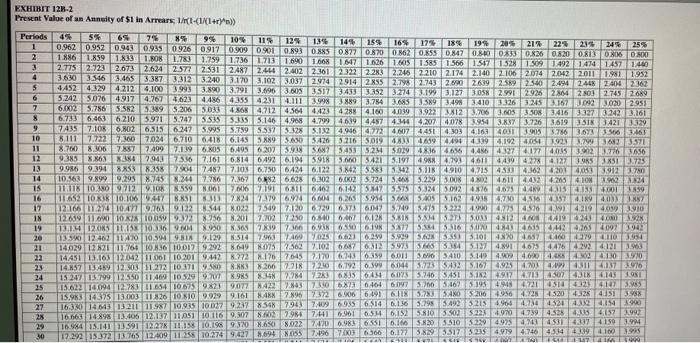

Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables.

Required:

Calculate the net present value of this investment opportunity. (Round your final answer to the nearest whole dollar amount.)

RXH1H11 12B-1 Fresnt Valae ef 5 H iCl+FM1 RNHIHIT 12R-2 Present Valae of an Anneity of $1 in Arrears; 1/1(1+(1N(1+D))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts