Question: Please answer both two parts On January 2, 2016, Pet Retreat purchased fixtures for $31,800 cash, expecting the fixtures to remain in service for eight

Please answer both two parts

answer both two parts

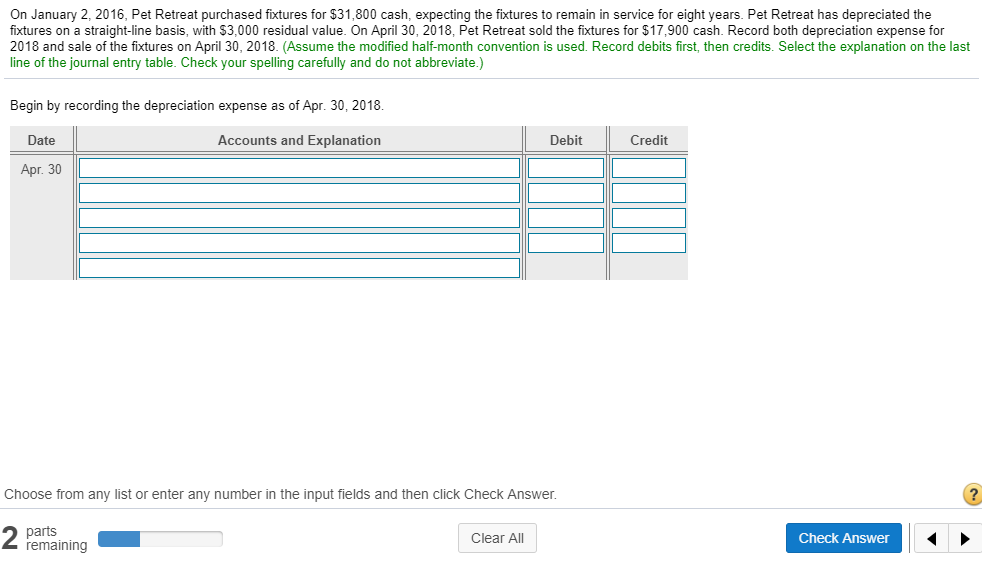

On January 2, 2016, Pet Retreat purchased fixtures for $31,800 cash, expecting the fixtures to remain in service for eight years. Pet Retreat has depreciated the fixtures on a straight-line basis, with $3,000 residual value. On April 30, 2018, Pet Retreat sold the fixtures for $17,900 cash. Record both depreciation expense for 2018 and sale of the fixtures on April 30, 2018. (Assume the modified half-month convention is used. Record debits first, then credits. Select the explanation on the last ine of the journal entry table. Check your spelling carefully and do not abbreviate.) Begin by recording the depreciation expense as of Apr. 30, 2018. Date Accounts and Explanation Debit Credi Credit Apr. 30 Choose from any list or enter any number in the input fields and then click Check Answer. 2 Clear All Check Answer remaining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts