Question: please answer both will upvote Desert, Inc. needs to accumulate $100,000 in a bond sinking fund at the end of 3 years to retire debt.

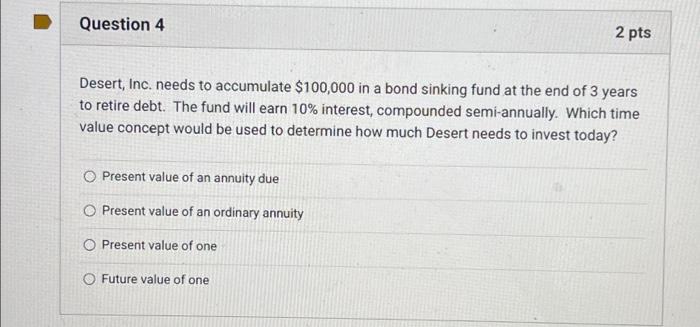

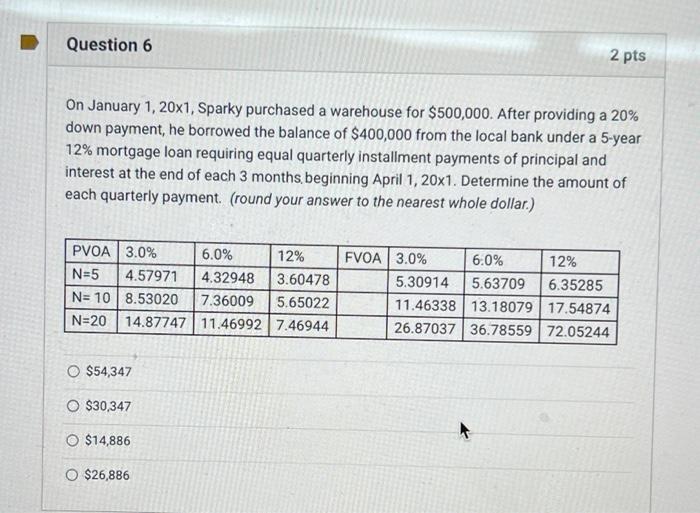

Desert, Inc. needs to accumulate $100,000 in a bond sinking fund at the end of 3 years to retire debt. The fund will earn 10% interest, compounded semi-annually. Which time value concept would be used to determine how much Desert needs to invest today? Present value of an annuity due Present value of an ordinary annuity Present value of one Future value of one On January 1, 20x1, Sparky purchased a warehouse for $500,000. After providing a 20% down payment, he borrowed the balance of $400,000 from the local bank under a 5-year 12% mortgage loan requiring equal quarterly installment payments of principal and interest at the end of each 3 months beginning April 1, 20x1. Determine the amount of each quarterly payment. (round your answer to the nearest whole dollar.) $54,347 $30,347 $14,886 $26,886

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts