Question: please answer bottom question using the following data. will give thumbs up!!!!! 30-33 Your company is considering an expansion project that will cost $1.5 million.

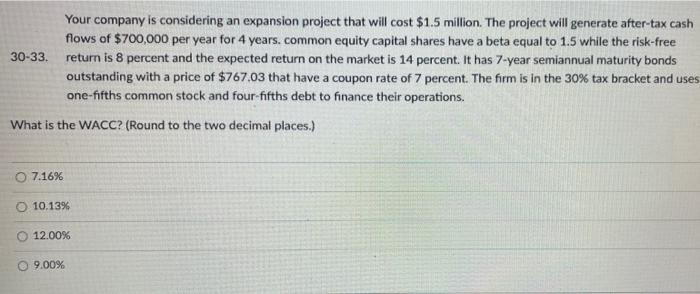

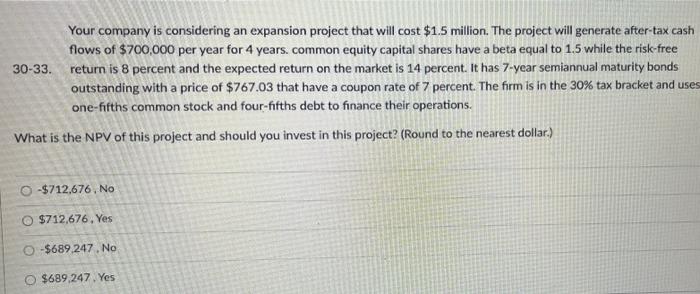

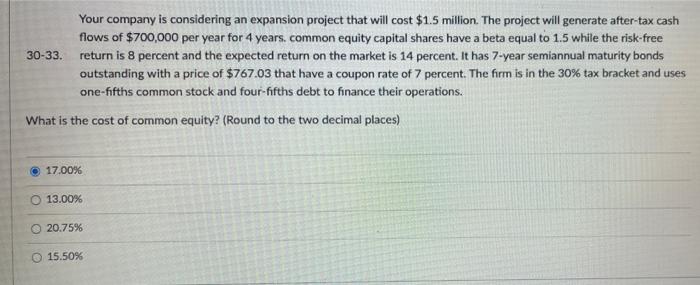

30-33 Your company is considering an expansion project that will cost $1.5 million. The project will generate after-tax cash flows of $700,000 per year for 4 years. common equity capital shares have a beta equal to 1.5 while the risk-free return is 8 percent and the expected return on the market is 14 percent. It has 7-year semiannual maturity bonds outstanding with a price of $767.03 that have a coupon rate of 7 percent. The firm is in the 30% tax bracket and uses one-fifths common stock and four-fifths debt to finance their operations. What is the WACC? (Round to the two decimal places.) 7.16% O 10.13% 12.00% 9.00% Your company is considering an expansion project that will cost $1.5 million. The project will generate after-tax cash flows of $700,000 per year for 4 years. common equity capital shares have a beta equal to 1.5 while the risk-free 30-33 return is 8 percent and the expected return on the market is 14 percent. It has 7-year semiannual maturity bonds outstanding with a price of $767.03 that have a coupon rate of 7 percent. The firm is in the 30% tax bracket and uses one-fifths common stock and four-fifths debt to finance their operations. What is the NPV of this project and should you invest in this project? (Round to the nearest dollar.) -$712,676. No O $712,676. Yes -$689 247.No $689.247. Yes Your company is considering an expansion project that will cost $1.5 million. The project will generate after-tax cash flows of $700,000 per year for 4 years. common equity capital shares have a beta equal to 1.5 while the risk-free 30-33. return is 8 percent and the expected return on the market is 14 percent. It has 7-year semiannual maturity bonds outstanding with a price of $767.03 that have a coupon rate of 7 percent. The firm is in the 30% tax bracket and uses one-fifths common stock and four-fifths debt to finance their operations. What is the cost of common equity? (Round to the two decimal places) 17.00% 13.00% O 20.75% 15.50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts