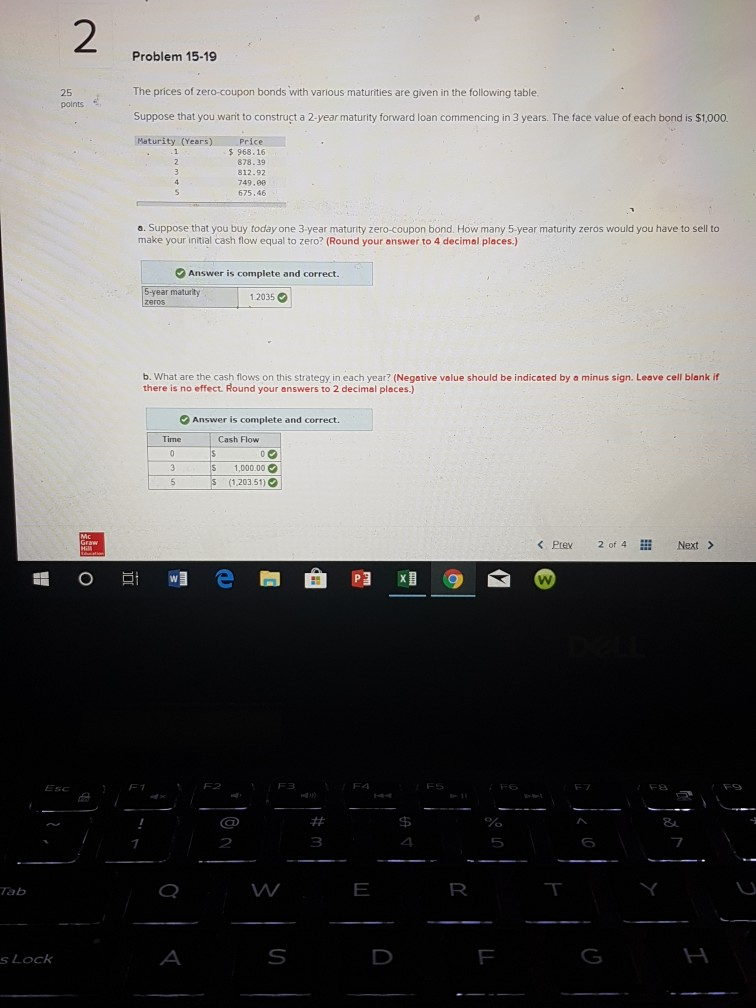

Question: please answer C and D 2 Problem 15-19 The prices of zero-coupon bonds with various maturities are given in the following table Suppose that you

please answer C and D

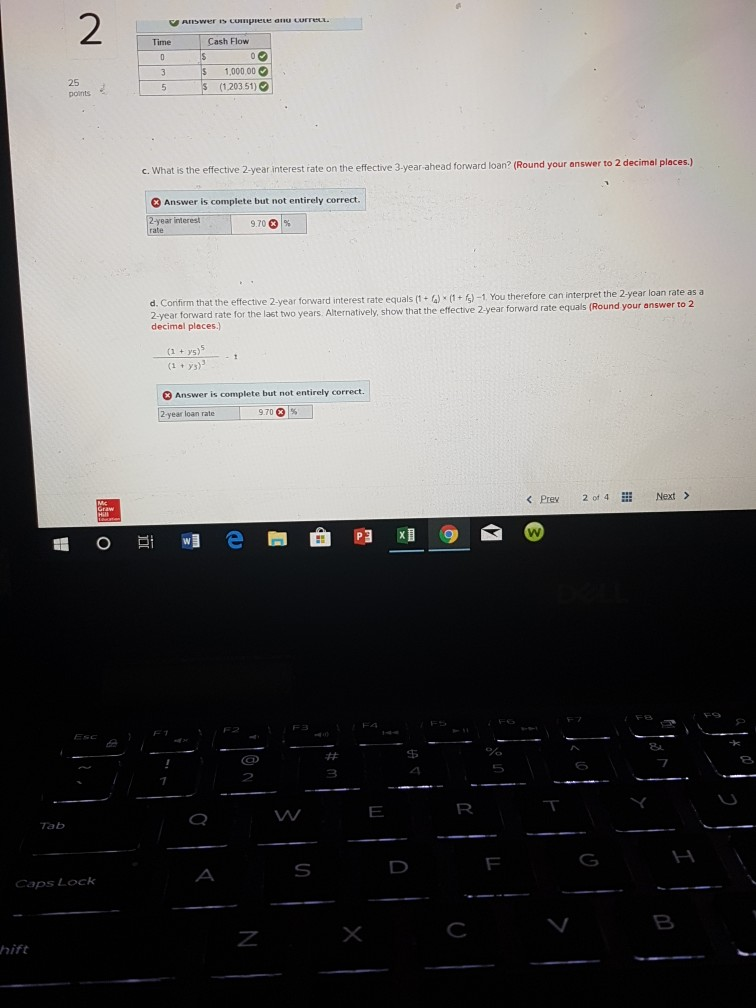

2 Problem 15-19 The prices of zero-coupon bonds with various maturities are given in the following table Suppose that you wart to construt a 2-year maturity forward loan commencing in 3 years. The face value of each bond is $1,000. 25 Maturity (Years) Price 968.16 878.39 812.92 749.00 675,46 a. Suppose that you buy today one 3 year maturity zero-coupon bond. How many 5-year maturity zeros would you have to sell to make your initial cash flow equal to zero? (Round your answer to 4 decimal places.) Answer is complete and correct. 12035 b. What are the cash flows on this strategy in each year? (Negative value should be indicated by a minus sign. Leave cell blank if there is no effect. Round your answers to 2 decimal places.) Answer is complete and correct. Cash Flow 1,000.00 (120351) EsC F8 79 7 3 Tab s Lock 2 Cash Flovw s 1,000 00 (1203 51) 25 5 c. What is the effective 2-year interest rate on the effective 3-year-ahead forward loan? (Round your answer to 2 decimal places.) 3 Answer is complete but not entirely correct. 2-year interest 9700s d. Confirm that the effective 2-year forward interest rate equals (1 + 4)" (1 + -1 You t 2-year forward rate for the last two years. Alternatively, show that the effective 2-year fo decimal places,) rward rate equals (Round your answer to 2 1+ys) 3 Answer is complete but not entirely correct year loan rate 9700% FS F2 7 Tab Caps Lock hift

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts