Question: please answer c, d and e. GO F fa P i A organized X Corporation by transferring the following: inventory with PROBLEMS 1. a basis

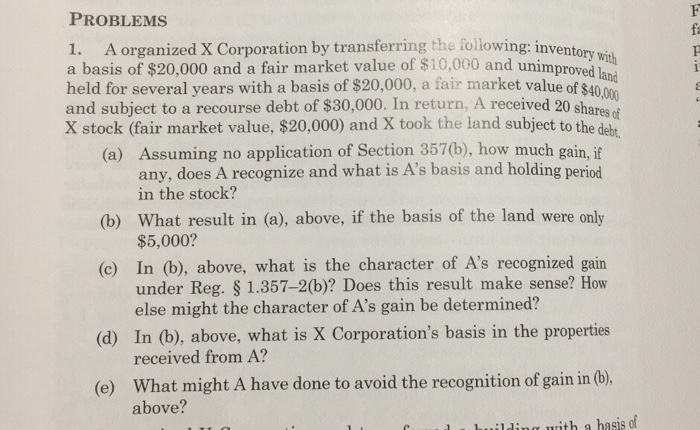

GO F fa P i A organized X Corporation by transferring the following: inventory with PROBLEMS 1. a basis of $20,000 and a fair market value of $10,000 and unimproved land held for several years with a basis of $20,000, a fair market value of $40,000 and subject to a recourse debt of $30,000. In return, A received 20 shares of X stock (fair market value, $20,000) and X took the land subject to the debt. (a) Assuming no application of Section 357(b), how much gain, if any, does A recognize and what is A's basis and holding period in the stock? (b) What result in (a), above, if the basis of the land were only $5,000? (c) In (b), above, what is the character of A's recognized gain under Reg. $ 1.357-2(b)? Does this result make sense? How else might the character of A's gain be determined? (d) In (b), above, what is X Corporation's basis in the properties received from A? (e) What might A have done to avoid the recognition of gain in (b), above? ilding with a hasis of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts