Question: Please answer c Problem 27-20 Interest rate swaps In June 2021, swap dealers were quoting a rate for five-year sterling interest-rate swaps of 5.40% against

Please answer c

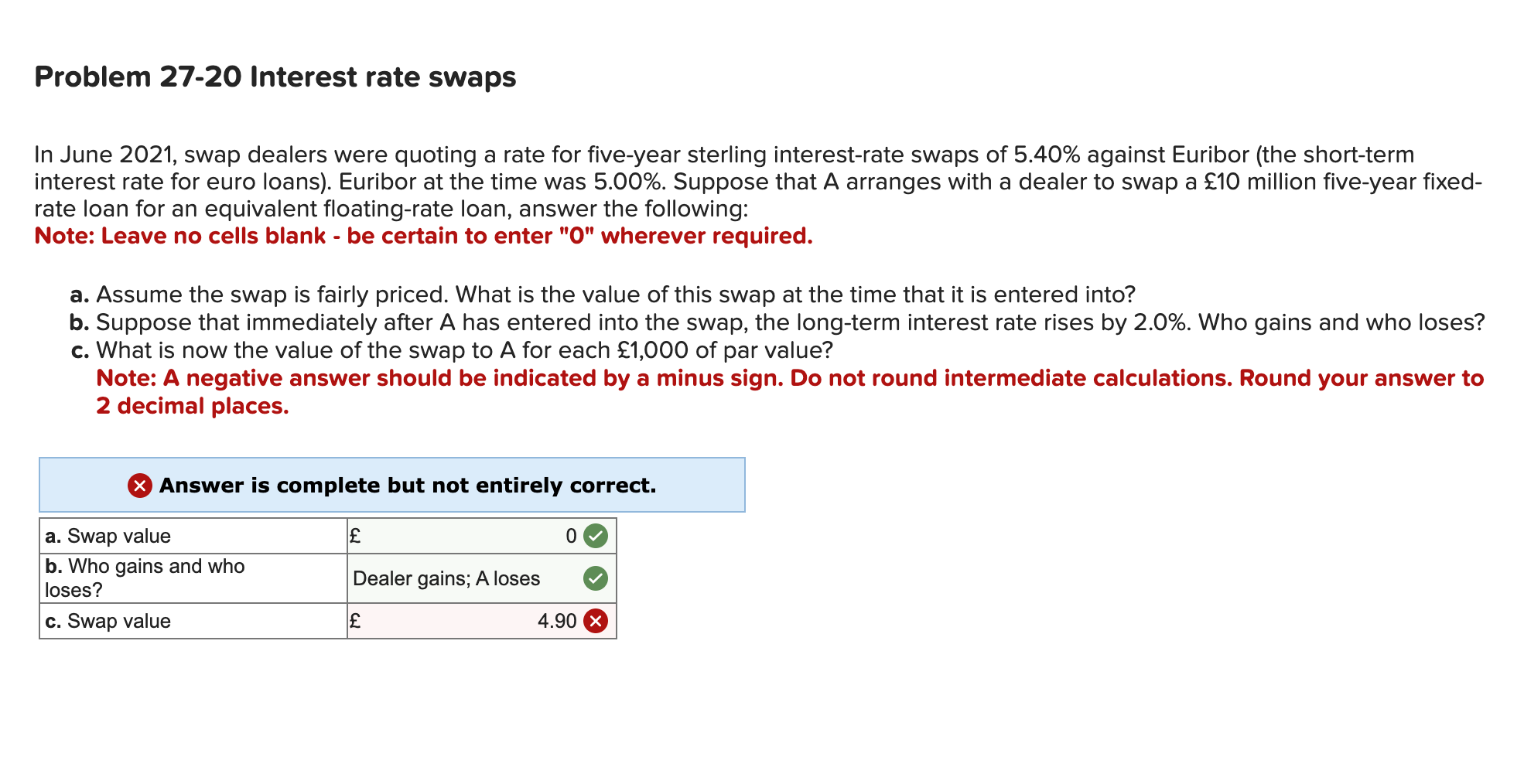

Problem 27-20 Interest rate swaps In June 2021, swap dealers were quoting a rate for five-year sterling interest-rate swaps of 5.40% against Euribor (the short-term interest rate for euro loans). Euribor at the time was 5.00\%. Suppose that A arranges with a dealer to swap a 10 million five-year fixedrate loan for an equivalent floating-rate loan, answer the following: Note: Leave no cells blank - be certain to enter "0" wherever required. a. Assume the swap is fairly priced. What is the value of this swap at the time that it is entered into? b. Suppose that immediately after A has entered into the swap, the long-term interest rate rises by 2.0%. Who gains and who loses? c. What is now the value of the swap to A for each 1,000 of par value? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts