Question: Please answer C Question 3 A British university endowment is concerned about the recent market volatility and so they have re-evaluated their investment policy. In

Please answer C

Please answer C

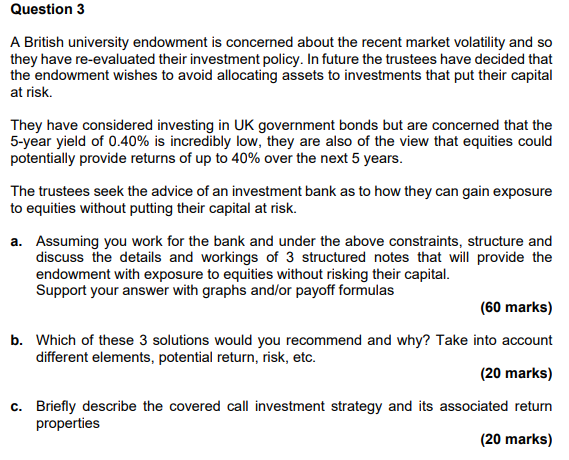

Question 3 A British university endowment is concerned about the recent market volatility and so they have re-evaluated their investment policy. In future the trustees have decided that the endowment wishes to avoid allocating assets to investments that put their capital at risk. They have considered investing in UK government bonds but are concerned that the 5-year yield of 0.40% is incredibly low, they are also of the view that equities could potentially provide returns of up to 40% over the next 5 years. The trustees seek the advice of an investment bank as to how they can gain exposure to equities without putting their capital at risk. a. Assuming you work for the bank and under the above constraints, structure and discuss the details and workings of 3 structured notes that will provide the endowment with exposure to equities without risking their capital. Support your answer with graphs and/or payoff formulas (60 marks) b. Which of these 3 solutions would you recommend and why? Take into account different elements, potential return, risk, etc. (20 marks) C. Briefly describe the covered call investment strategy and its associated return properties (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts