Question: Please answer C Question 5 Prof. Doldrums believes that equity markets are currently at fair value and is of the view that they will not

Please answer C

Please answer C

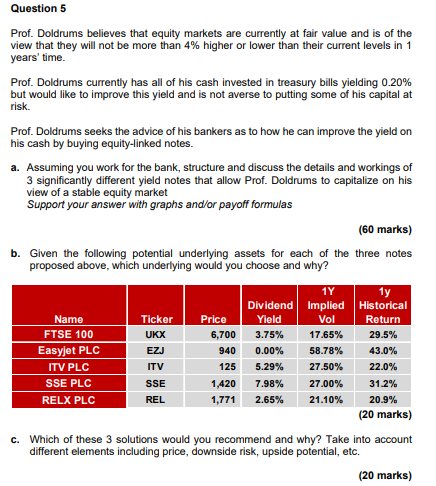

Question 5 Prof. Doldrums believes that equity markets are currently at fair value and is of the view that they will not be more than 4% higher or lower than their current levels in 1 years' time. Prof. Doldrums currently has all of his cash invested in treasury bills yielding 0.20% but would like to improve this yield and is not averse to putting some of his capital at risk. Prof. Doldrums seeks the advice of his bankers as to how he can improve the yield on his cash by buying equity-linked notes. a. Assuming you work for the bank, structure and discuss the details and workings of 3 significantly different yield notes that allow Prof. Doldrums to capitalize on his view of a stable equity market Support your answer with graphs and/or payoff formulas (60 marks) b. Given the following potential underlying assets for each of the three notes proposed above, which underlying would you choose and why? 1Y 1y Dividend Implied Historical Name Ticker Price Yield Vol Return FTSE 100 UKX 6,700 3.75% 17.65% 29.5% Easyjet PLC EZJ 940 0.00% 58.78% 43.0% ITV PLC ITV 125 5.29% 27.50% 22.0% SSE PLC SSE 1,420 7.98% 27.00% 31.2% RELX PLC REL 1,771 2.65% 21.10% 20.9% (20 marks) c. Which of these 3 solutions would you recommend and why? Take into account different elements including price, downside risk, upside potential, etc. (20 marks) Question 5 Prof. Doldrums believes that equity markets are currently at fair value and is of the view that they will not be more than 4% higher or lower than their current levels in 1 years' time. Prof. Doldrums currently has all of his cash invested in treasury bills yielding 0.20% but would like to improve this yield and is not averse to putting some of his capital at risk. Prof. Doldrums seeks the advice of his bankers as to how he can improve the yield on his cash by buying equity-linked notes. a. Assuming you work for the bank, structure and discuss the details and workings of 3 significantly different yield notes that allow Prof. Doldrums to capitalize on his view of a stable equity market Support your answer with graphs and/or payoff formulas (60 marks) b. Given the following potential underlying assets for each of the three notes proposed above, which underlying would you choose and why? 1Y 1y Dividend Implied Historical Name Ticker Price Yield Vol Return FTSE 100 UKX 6,700 3.75% 17.65% 29.5% Easyjet PLC EZJ 940 0.00% 58.78% 43.0% ITV PLC ITV 125 5.29% 27.50% 22.0% SSE PLC SSE 1,420 7.98% 27.00% 31.2% RELX PLC REL 1,771 2.65% 21.10% 20.9% (20 marks) c. Which of these 3 solutions would you recommend and why? Take into account different elements including price, downside risk, upside potential, etc. (20 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts