Question: Please answer C The Three Stages partnership is considering three long-term capital investment proposals. Each investment has a useful life of ve years. Relevant data

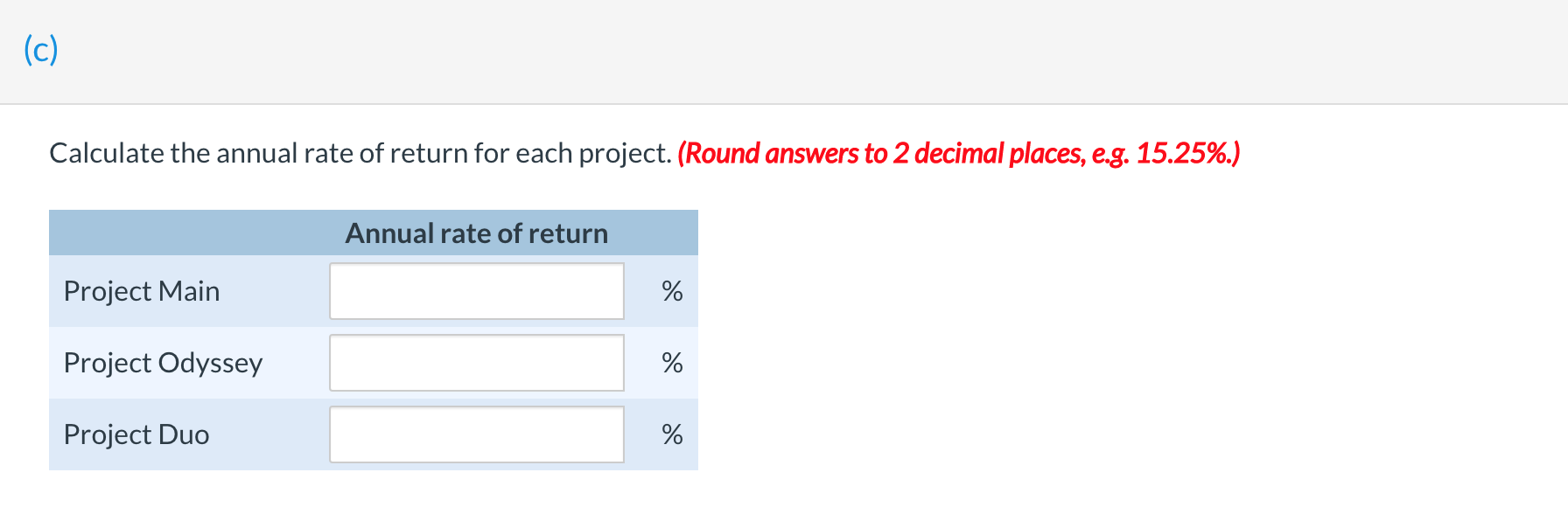

Please answer C

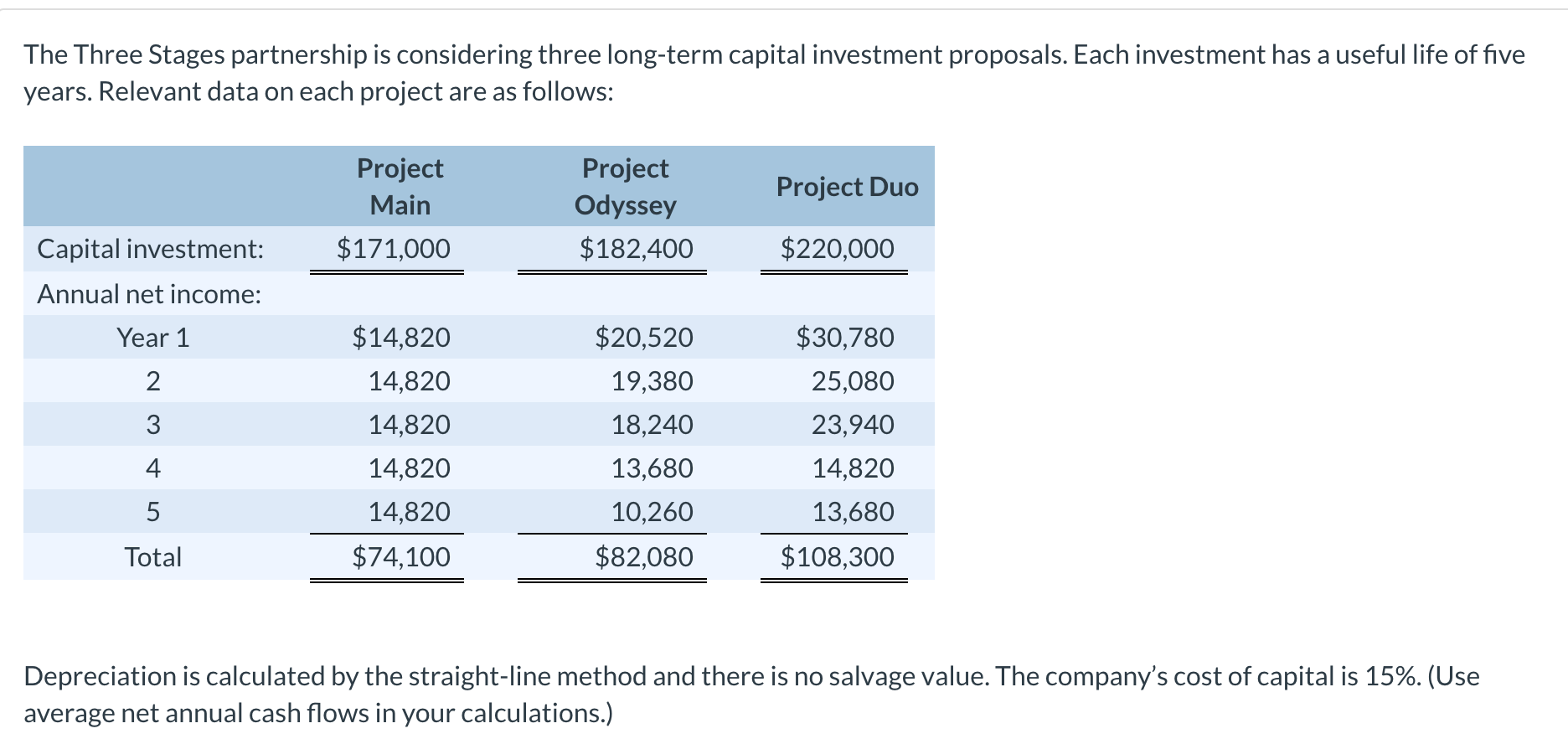

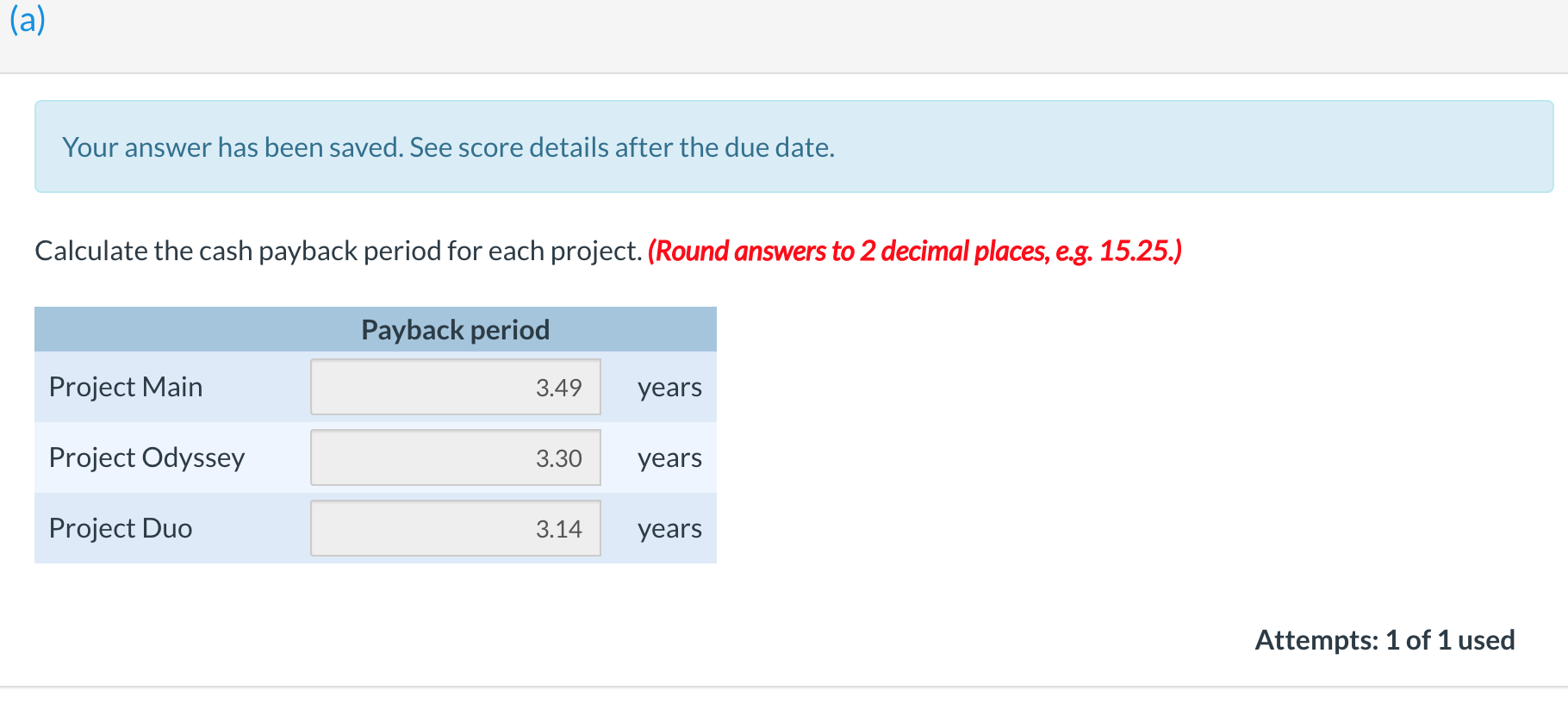

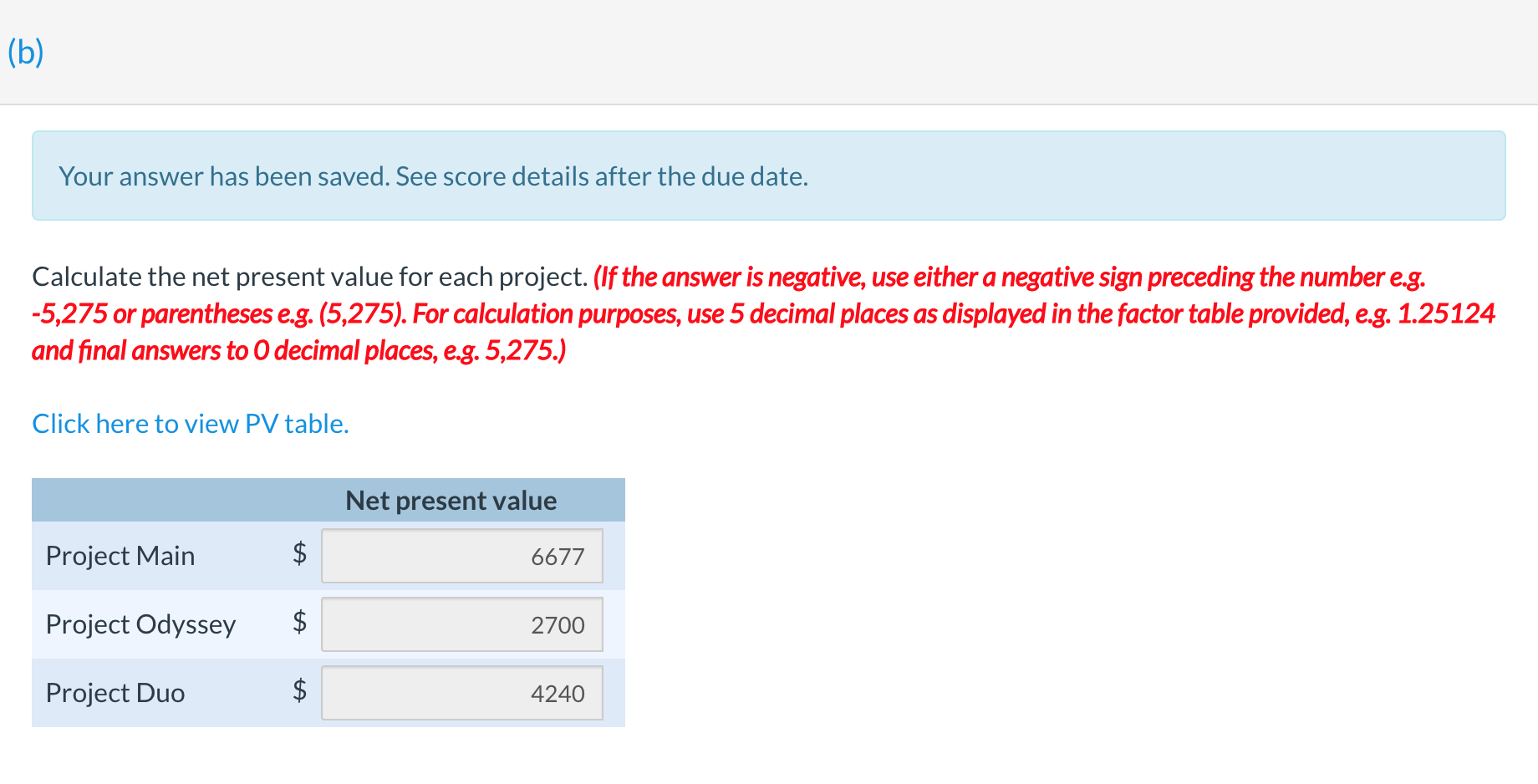

The Three Stages partnership is considering three long-term capital investment proposals. Each investment has a useful life of ve years. Relevant data on each project are as follows: Capital investment: $171,000 $182,400 $220,000 Annual net income: Year 1 $14,820 $20,520 $30,780 2 14,820 19,380 25,080 3 14,820 18,240 23,940 4 14,820 13,680 14,820 5 14,820 10,260 13,680 Total $74,100 $82,080 $108,300 Depreciation is calculated by the straight-line method and there is no salvage value. The company's cost of capital is 15%. (Use average net annual cash ows in your calculations.) (a) Your answer has been saved. See score details after the due date. Calculate the cash payback period for each project. (Round answers to 2 decimal places, as. 15.25.) Project Odyssey 3.30 yea rs Project Duo 3.14 years Attempts: 1 of 1 used (b) Your answer has been saved. See score details after the due date. Calculate the net present value for each project. (If the answer is negative, use either a negative sign preceding the number e.g. -5,275 or parentheses e.g. (5,275). For calculation purposes, use 5 decimal places as displayed in the factor table provided, e.g. 1.25124 and final answers to O decimal places, e.g. 5,275.) Click here to view PV table. Net present value Project Main tA 6677 Project Odyssey 2700 Project Duo 4240(C) Calculate the annual rate of return for each project. (Round answers to 2 decimal places, as. 15.25%.) Project Main % Project Odyssey % Project Duo %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts