Question: please answer case problem 10.1 questions a,b,c,d,e 64 Max and Veronica Shuman, along with their two teenage sons, Terry and Thomas, live in Portland, Oregon.

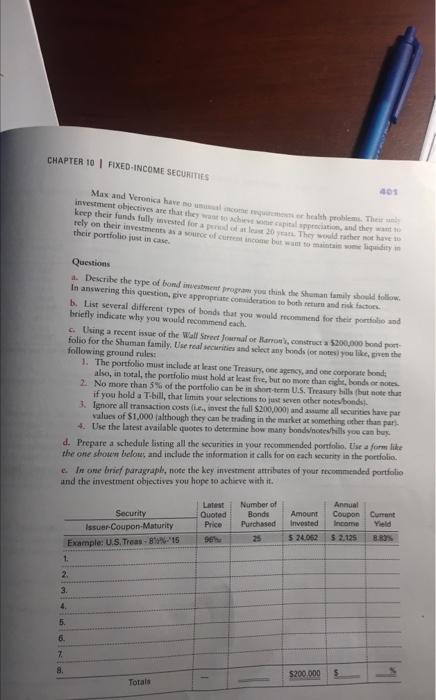

64 Max and Veronica Shuman, along with their two teenage sons, Terry and Thomas, live in Portland, Oregon. Max is a sales rep for a major medical firm, and Veronica is a personnel office at a local bank. Together, they earn an annual income of around $100,000. Max has just learned that his recently departed rich uncle has named him in his will to the tune of some $250,000 after taxes. Needless to say, the family is elated. Max intends to spend $50,000 of his inheritance on a number of long-overdue family items (like some badly needed remodeling of their kitchen and family room, the down payment on a new Porsche Boxster, and braces to correct Tom's overbite). Max wants to invest the remaining $200,000 in various types of fixed-income securities. investment objectives afe diset itacy. Questions a. Deceribe the type of bond anvecitorear progare you think the shoman family shorld follow. In answering this queition, give a ppenprate coetideratioe to both rrturn and ridk factork: b. List several different types of bonde that you would rroommend for their portinte and briefly indicate why you would reconmend each. c. Ucing a recent Eswae of the Wall Srect fournal of Ilsman h, whistruct a 5200.000 hond port: folio for the Shaman family. Vse real incurities and select any bonds (or noteri) you like, piven the following ground rales: 1. The portfolio must inclade at lrast one Trewury, cot agency, and oeic corporate bondy also, in total, she portiolio mast hold at least frie, but no avore than cight, bundi or noten. 2. No mure chan 5% of the portfolio can be in short term U.S. Treasury hills flut note thur if you hold a T-bill, that fimits your selections to jut seven other noteshondsy. 3. Ignore all transaction costs (ief, invest the full $200,000 ) and anume all iecurities have par values of $1.000 ialthough they can be trading in the marke at vorsething whet thas par- 4. Use the latest available quotes to determine bow many bondvicetevhilis yoe can boy. d. Prepare a whedule listing all the iecurities in your recommended portiolio, Zlis a form libe the one shouen belowe, and include the information it alls for oo cach sceunity in the portolio. e. In ape brief paragraple, note the key investment attrbutes of your recommended pontiolio. and the investment ohjective you hope so achicve with it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts