Question: Please answer c&d, Thank You!! Amount (RM) 404 August 20x9 20 23 26 Particulars Cheque no. 760404 Cheque no. 760405 Cheque no. 760406 Total 220

Please answer c&d, Thank You!!

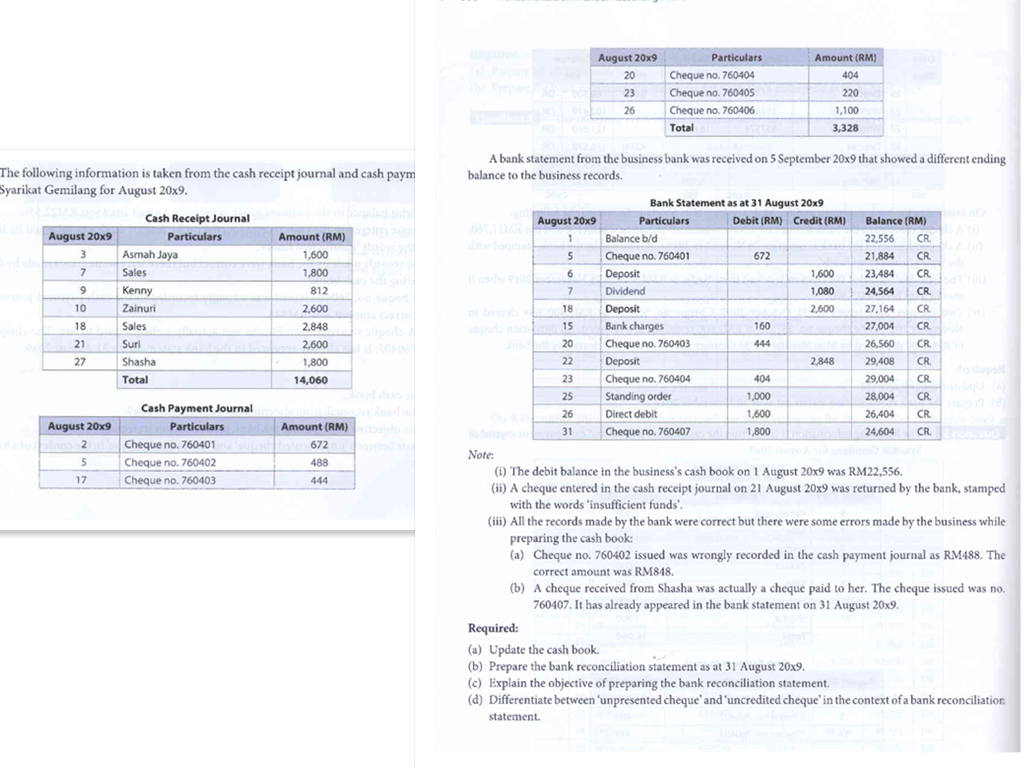

Amount (RM) 404 August 20x9 20 23 26 Particulars Cheque no. 760404 Cheque no. 760405 Cheque no. 760406 Total 220 1,100 3,328 The following information is taken from the cash receipt journal and cash paym Syarikat Gemilang for August 20x9. A bank statement from the business bank was received on 5 September 20x9 that showed a different ending balance to the business records. August 20x9 7 9 10 18 Cash Receipt Journal Particulars Asmah Jaya Sales Kenny Zainuri Sales Suri Shasha Total Amount (RM) 1,600 1,800 812 2,600 2.848 2,600 1,800 14,060 CR CR 21 27 CR CR August 20x9 2 5 17 Cash Payment Journal Particulars Cheque no. 760401 Cheque no. 760402 Cheque no. 760403 Amount (RM) 672 488 444 Bank Statement as at 31 August 20x9 August 20x9 Particulars Debit (RM) Credit (RM) Balance (RM) 1 Balance b/d 22,556 CR 5 Cheque no. 760401 672 21,884 CR 6 Deposit 1,600 23.484 CR 7 Dividend 1,080 24,564 CR 18 Deposit 2.600 27,164 15 Bank charges 160 27,004 20 Cheque no. 760403 26.560 CR. 22 Deposit 2,848 29,408 CR lupa Cheque no. 760404 23 404 29,004 25 Standing order 1,000 28,004 CR. 26 Direct debit 1,600 26,404 31 Cheque no. 760407 1,800 24,604 CR Note: (i) The debit balance in the business's cash book on 1 August 20x9 was RM22,556. (ii) A cheque entered in the cash receipt journal on 21 August 20x9 was returned by the bank, stamped with the words 'insufficient funds'. (iii) All the records made by the bank were correct but there were some errors made by the business while preparing the cash book: (a) Cheque no. 760402 issued was wrongly recorded in the cash payment journal as RM488. The correct amount was RM848. (b) A cheque received from Shasha was actually a cheque paid to her. The cheque issued was no. 760407. It has already appeared in the bank statement on 31 August 20x9. Required: (a) Update the cash book. (b) Prepare the bank reconciliation statement as at 31 August 20x9. (c) Explain the objective of preparing the bank reconciliation statement. (d) Differentiate between unpresented cheque' and 'uncredited cheque'in the context of a bank reconciliation statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts