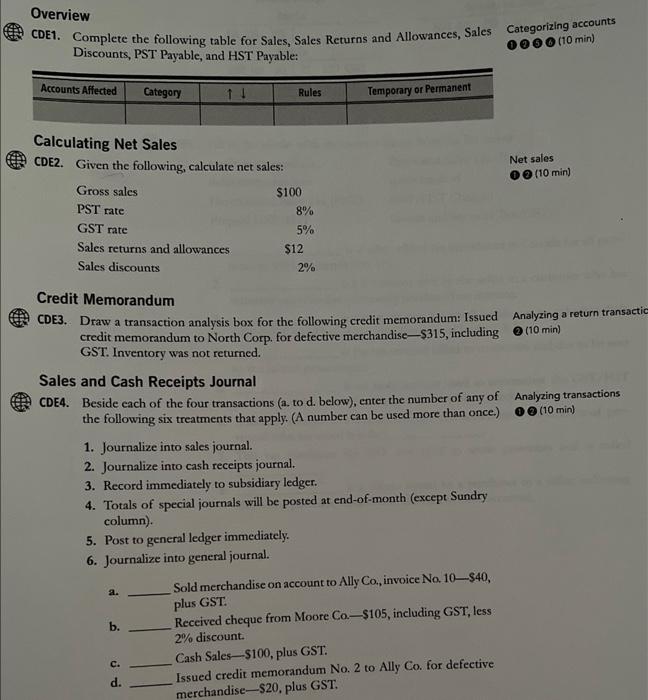

Question: please answer CDE 1-6 thank you Overview Discounts, PST Payable, and HST Payable: Calculating Net Sales CDE2. Given the following, calculate net sales: Net sales

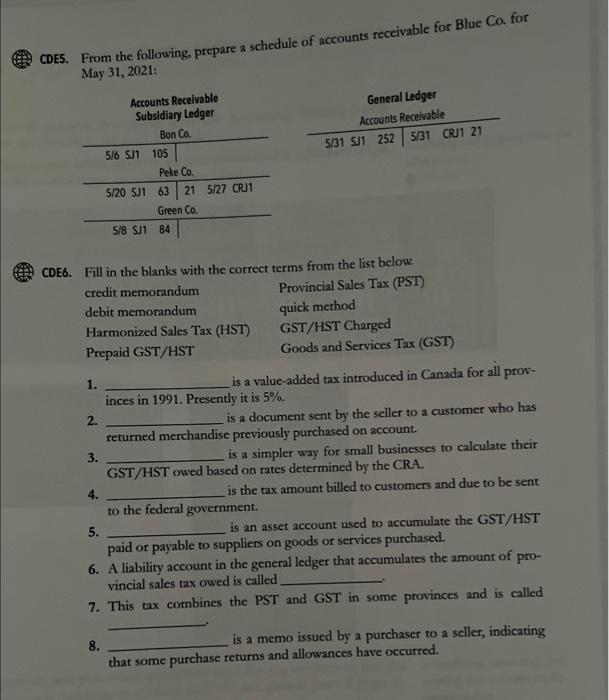

Overview Discounts, PST Payable, and HST Payable: Calculating Net Sales CDE2. Given the following, calculate net sales: Net sales ob (10min) Credit Memorandum CDE3. Draw a transaction analysis box for the following credit memorandum: Issued Analyzing a return transactic credit memorandum to North Corp. for defective merchandise $315, including 0(10min) GST. Inventory was not returned. Sales and Cash Receipts Journal CDE4. Beside each of the four transactions (a. to d. below), enter the number of any of Analyzing transactions the following six treatments that apply. (A number can be used more than once.) 0 o (10min) 1. Journalize into sales journal. 2. Journalize into cash receipts journal. 3. Record immediately to subsidiary ledger. 4. Totals of special journals will be posted at end-of-month (except Sundry column). 5. Post to general ledger immediately. 6. Journalize into general journal. a. Sold merchandise on account to Ally Co, invoice No. 10-\$40, plus GST. b. Received cheque from Moore Co $105, including GST, less 2% discount. c. Cash Sales-\$100, plus GST. d. Issued credit memorandum No. 2 to Ally Co. for defective merchandise-\$20, plus GST, CDE5. From the following, prepare a schedule of accounts receivable for Blue Co. for May 31, 2021: 1. is a value-added tax introduced in Canada for all provinces in 1991. Presently it is 5%. 2. is a document sent by the seller to a customer who has returned merchandise previously purchased on account. 3. is a simpler way for small businesses to calculate their GST/HST owed based on rates determined by the CRA. 4. is the tax amount billed to customers and due to be sent to the federal government. 5. is an asset account used to accumulate the GST/HST paid or payable to suppliers on goods or services purchased. 6. A liability account in the general ledger that accumulates the amount of provincial sales tax owed is called 7. This tax combines the PST and GST in some provinces and is called 8. is a memo issued by a purchaser to a seller, indicating that some purchase returns and allowances have occurred. Overview Discounts, PST Payable, and HST Payable: Calculating Net Sales CDE2. Given the following, calculate net sales: Net sales ob (10min) Credit Memorandum CDE3. Draw a transaction analysis box for the following credit memorandum: Issued Analyzing a return transactic credit memorandum to North Corp. for defective merchandise $315, including 0(10min) GST. Inventory was not returned. Sales and Cash Receipts Journal CDE4. Beside each of the four transactions (a. to d. below), enter the number of any of Analyzing transactions the following six treatments that apply. (A number can be used more than once.) 0 o (10min) 1. Journalize into sales journal. 2. Journalize into cash receipts journal. 3. Record immediately to subsidiary ledger. 4. Totals of special journals will be posted at end-of-month (except Sundry column). 5. Post to general ledger immediately. 6. Journalize into general journal. a. Sold merchandise on account to Ally Co, invoice No. 10-\$40, plus GST. b. Received cheque from Moore Co $105, including GST, less 2% discount. c. Cash Sales-\$100, plus GST. d. Issued credit memorandum No. 2 to Ally Co. for defective merchandise-\$20, plus GST, CDE5. From the following, prepare a schedule of accounts receivable for Blue Co. for May 31, 2021: 1. is a value-added tax introduced in Canada for all provinces in 1991. Presently it is 5%. 2. is a document sent by the seller to a customer who has returned merchandise previously purchased on account. 3. is a simpler way for small businesses to calculate their GST/HST owed based on rates determined by the CRA. 4. is the tax amount billed to customers and due to be sent to the federal government. 5. is an asset account used to accumulate the GST/HST paid or payable to suppliers on goods or services purchased. 6. A liability account in the general ledger that accumulates the amount of provincial sales tax owed is called 7. This tax combines the PST and GST in some provinces and is called 8. is a memo issued by a purchaser to a seller, indicating that some purchase returns and allowances have occurred

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts