Question: Please answer clearly and in an organaized way thanks Preparing the Operating Activities Section The following items are relevant to the preparation of a statement

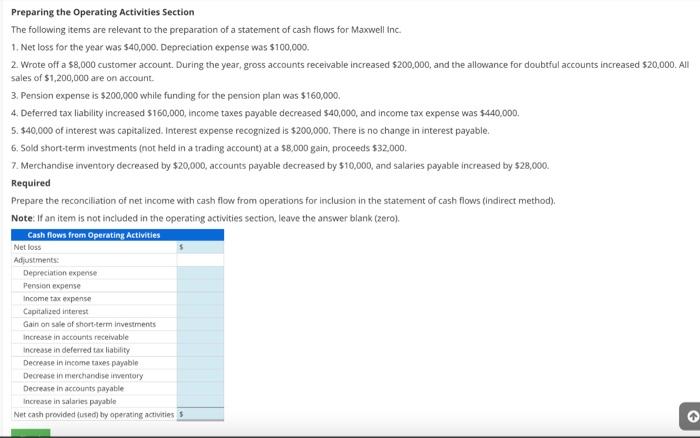

Preparing the Operating Activities Section The following items are relevant to the preparation of a statement of cash flows for Maxwell inc. 1. Net loss for the year was $40,000. Depreciation expense was $100,000. 2. Wrote off a $8,000 customer account. During the year, gross accounts receivable increased $200,000, and the allowance for doubtful accounts increased $20,000. All sales of $1,200,000 are on account. 3. Pension expense is $200,000 while funding for the pension plan was $160,000. 4. Deferred tax liability increased $160,000, income taxes payable decreased $40,000, and income tax expense was $440,000. 5. $40,000 of interest was capitalized. Interest expense recognized is $200,000. There is no change in interest payable. 6. Sold short-term investments (not heid in a trading account) at a $8,000gain, proceeds $32,000. 7. Merchandise imventory decreased by $20,000, accounts payable decreased by $10,000, and salaries payable increased by $28,000. Required Prepare the reconciliation of net income with cash flow from operations for inclusion in the statement of cash flows (indirect method). Note: If an item is not included in the operating activities section, leave the answer blank (zero)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts