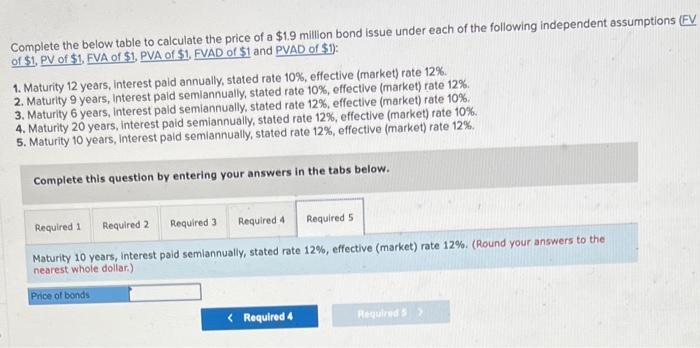

Question: please answer clearly Complete the below table to calculate the price of a $1.9 million bond issue under each of the following independent assumptions (FV

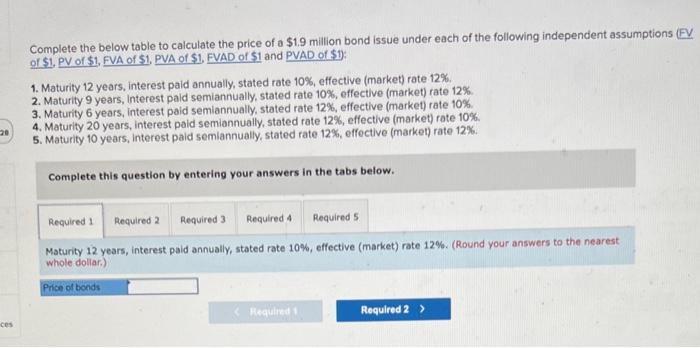

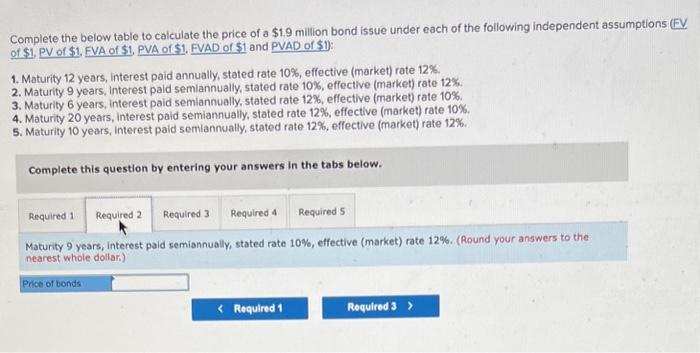

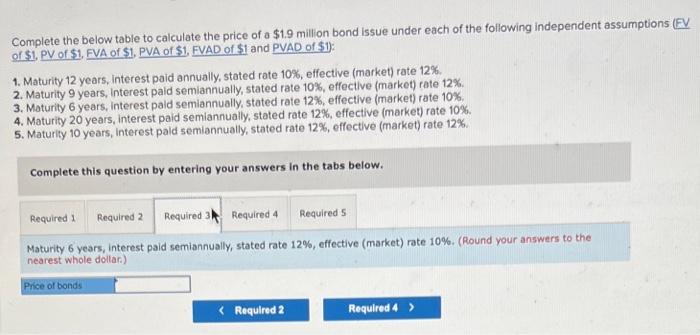

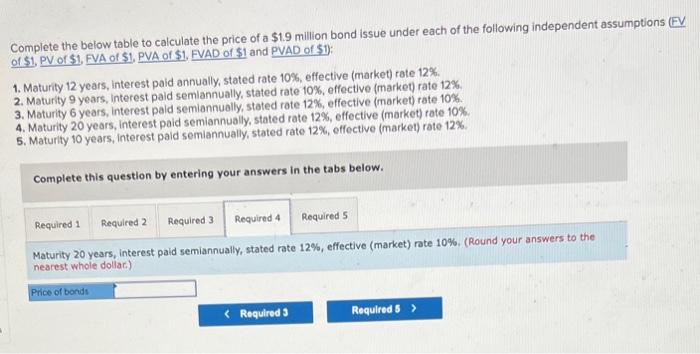

Complete the below table to calculate the price of a $1.9 million bond issue under each of the following independent assumptions (FV of $1. PV of $1, FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1; : 1. Maturity 12 years, interest paid annually, stated rate 10%, effective (market) rate 12%, 2. Maturity 9 years, interest paid semiannually, stated rate 10%, effective (market) rate 12%. 3. Maturity 6 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 4. Maturity 20 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 5. Maturity 10 years, interest paid semiannually, stated rate 12\%, effective (market) rate 12%. Complete this question by entering your answers in the tabs below. Maturity 12 years, interest paid annually, stated rate 10%, effective (market) rate 12%. (Round your answers to the nearest whole dollar.) Complete the below table to calculate the price of a $1.9 million bond issue under each of the following independent assumptions (FV of $1, PV of $1. FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 : 1. Maturity 12 years, interest paid annually, stated rate 10%, effective (market) rate 12%, 2. Maturity 9 years, interest pald semiannually, stated rate 10\%, effective (market) rate 12%. 3. Maturity 6 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 4. Maturity 20 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 5. Maturity 10 years, interest paid semlannually, stated rate 12%, effective (market) rate 12%. Complete this question by entering your answers in the tabs below. Maturity 9 years, interest pald semiannually, stated rate 10%, effective (market) rate 12%. (Round your answers to the nearest whole dollar) Complete the below table to calculate the price of a $1.9 million bond issue under each of the following independent assumptions (EV of $1. PV of $1, FVA of \$1. PVA of $1, FVAD of $1 and PVAD of $1 : 1. Maturity 12 years, interest paid annually, stated rate 10%, effective (market) rate 12%. 2. Maturity 9 years, Interest paid semiannually, stated rate 10%, effective (market) rate 12%. 3. Maturity 6 years, interest paid semiannually, stated rate 12\%, effective (market) rate 10%. 4. Maturity 20 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 5. Maturity 10 years, interest pald semiannually, stated rate 12%, effective (market) rate 12%. Complete this question by entering your answers in the tabs below. Maturity 6 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. (Round your answers to the nearest whole dollar.) Complete the below table to calculate the price of a $1.9 milion bond issue under each of the following independent assumptions (FV of $1, PV or $1, FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1 : 1. Maturity 12 years, interest paid annually, stated rate 10%, effective (market) rate 12%. 2. Maturity 9 years, interest paid semlannually, stated rate 10%, effective (market) rate 12%. 3. Maturity 6 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 4. Maturity 20 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 5. Maturity 10 years, interest paid semiannually, stated rate 12%, effective (market) rate 12%. Complete this question by entering your answers in the tabs below. Maturity 20 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. (Round your answers to the nearest whole doliac) Complete the below table to calculate the price of a $1.9 million bond issue under each of the following independent assumptions (FV of $1, PV of $1. FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1): 1. Maturity 12 years, interest paid annually, stated rate 10%, effective (market) rate 12%. 2. Maturity 9 years, interest paid semiannually, stated rate 10\%, effective (market) rate 12%. 3. Maturity 6 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 4. Maturity 20 years, interest paid semiannually, stated rate 12%, effective (market) rate 10%. 5. Maturity 10 years, interest pald semiannually, stated rate 12%, effective (market) rate 12%. Complete this question by entering your answers in the tabs below. Maturity 10 years, interest paid semlannually, stated rate 12%, effective (market) rate 12%. (Round your answers to the nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts