Question: PLEASE ANSWER CLEARLY... Requlred lnformation [The following information applies to the questions displayed below.] Onslow Company purchased a used machine for $192,000 cash on January

![displayed below.] Onslow Company purchased a used machine for $192,000 cash on](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e84c7f6e281_96766e84c7f0f533.jpg)

PLEASE ANSWER CLEARLY...

PLEASE ANSWER CLEARLY...

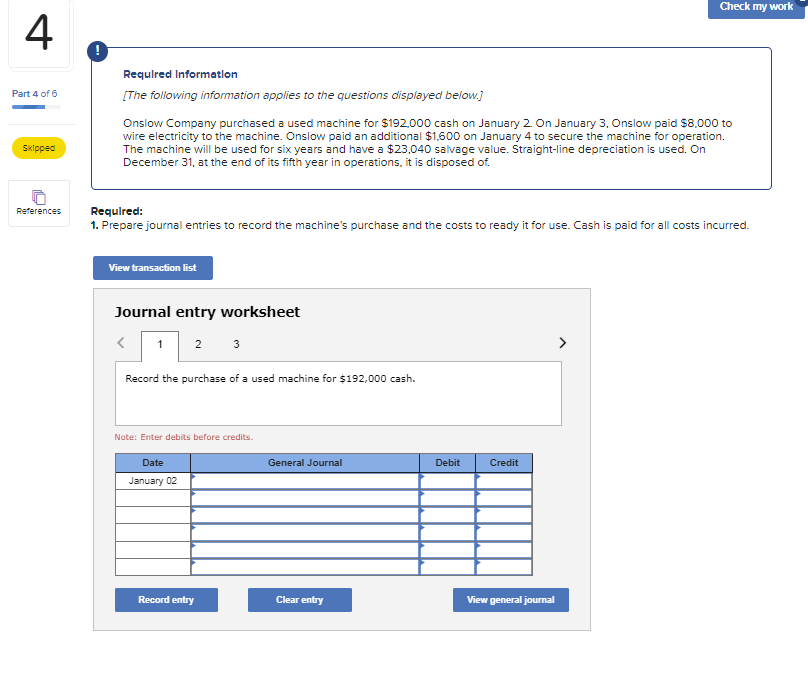

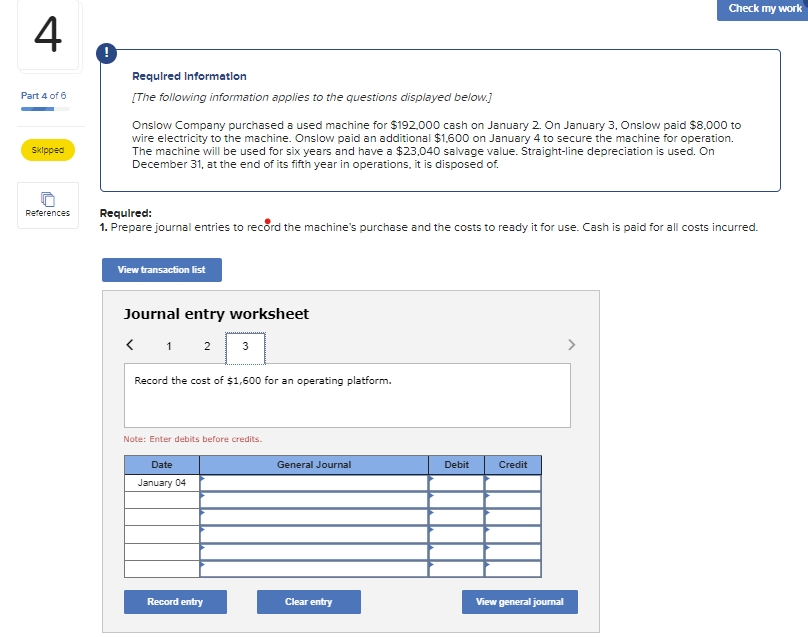

Requlred lnformation [The following information applies to the questions displayed below.] Onslow Company purchased a used machine for $192,000 cash on January 2 . On January 3 , Onslow paid $8,000 to wire electricity to the machine. Onslow paid an additional $1,600 on January 4 to secure the machine for operation. The machine will be used for six years and have a $23,040 salvage value. Straight-line depreciation is used. On December 31 , at the end of its fifth year in operations, it is disposed of. equlred: Prepare journal entries to record the machine's purchase and the costs to ready it for use. Cash is paid for all costs incurred. Journal entry worksheet Record the purchase of a used machine for $192,000 cash. Note: Enter debits before credits. Requlred Informatlon [The following information applies to the questions displayed below.] Onslow Company purchased a used machine for $192,000 cash on January 2 . On January 3 , Onslow paid $8,000 to wire electricity to the machine. Onslow paid an additional $1,600 on January 4 to secure the machine for operation. The machine will be used for six years and have a $23,040 salvage value. Straight-line depreciation is used. On December 31 , at the end of its fifth year in operations, it is disposed of. iequlred: Prepare journal entries to record the machine's purchase and the costs to ready it for use. Cash is paid for all costs incurred. Journal entry worksheet 3 Record the costs of $8,000 incurred on the used machine. Note: Enter debits before credits. Requlred Informatlon [The following information applies to the questions displayed below.] Onslow Company purchased a used machine for $192,000 cash on January 2 . On January 3 , Onslow paid $8,000 to wire electricity to the machine. Onslow paid an additional $1,600 on January 4 to secure the machine for operation. The machine will be used for six years and have a $23,040 salvage value. Straight-line depreciation is used. On December 31 , at the end of its fifth year in operations, it is disposed of. squlred: Prepare journal entries to recoord the machine's purchase and the costs to ready it for use. Cash is paid for all costs incurred. Journal entry worksheet Record the cost of $1,600 for an operating platform. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts