Question: please answer (Common stock valuation) Bates Inc. pays a dividend of $2.50 and is currently selling for $37.45. If investors require a return of 13

please answer

please answer

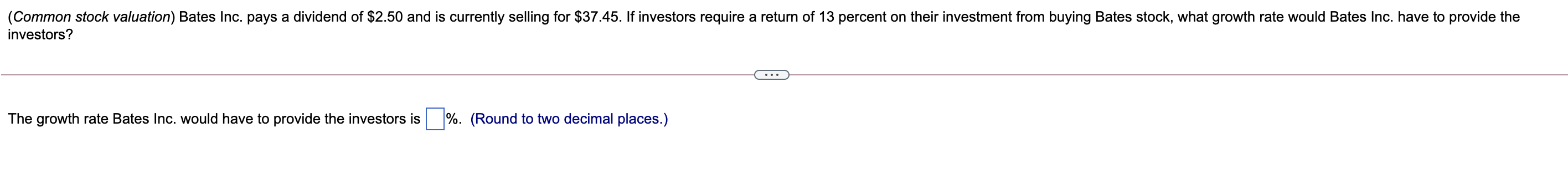

(Common stock valuation) Bates Inc. pays a dividend of $2.50 and is currently selling for $37.45. If investors require a return of 13 percent on their investment from buying Bates stock, what growth rate would Bates Inc. have to provide the investors? The growth rate Bates Inc. would have to provide the investors is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock