Question: PLEASE ANSWER COMPLETE AND CORRECT, DO NOT ACCEPT QUESTION IF YOU DO NOT KNOW HOW TO ANSWER. PLEASE ALSO DISPLAY THE ANSWERS IN AN EASY

PLEASE ANSWER COMPLETE AND CORRECT, DO NOT ACCEPT QUESTION IF YOU DO NOT KNOW HOW TO ANSWER. PLEASE ALSO DISPLAY THE ANSWERS IN AN EASY TO TRANSCRIBE MANNER.

PLEASE ANSWER COMPLETE AND CORRECT, DO NOT ACCEPT QUESTION IF YOU DO NOT KNOW HOW TO ANSWER. PLEASE ALSO DISPLAY THE ANSWERS IN AN EASY TO TRANSCRIBE MANNER.

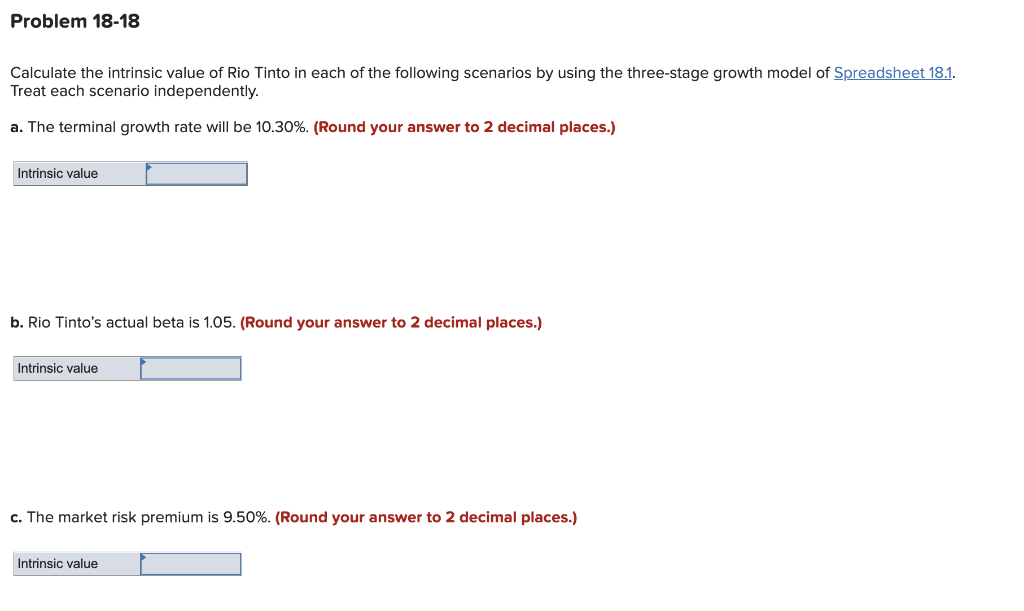

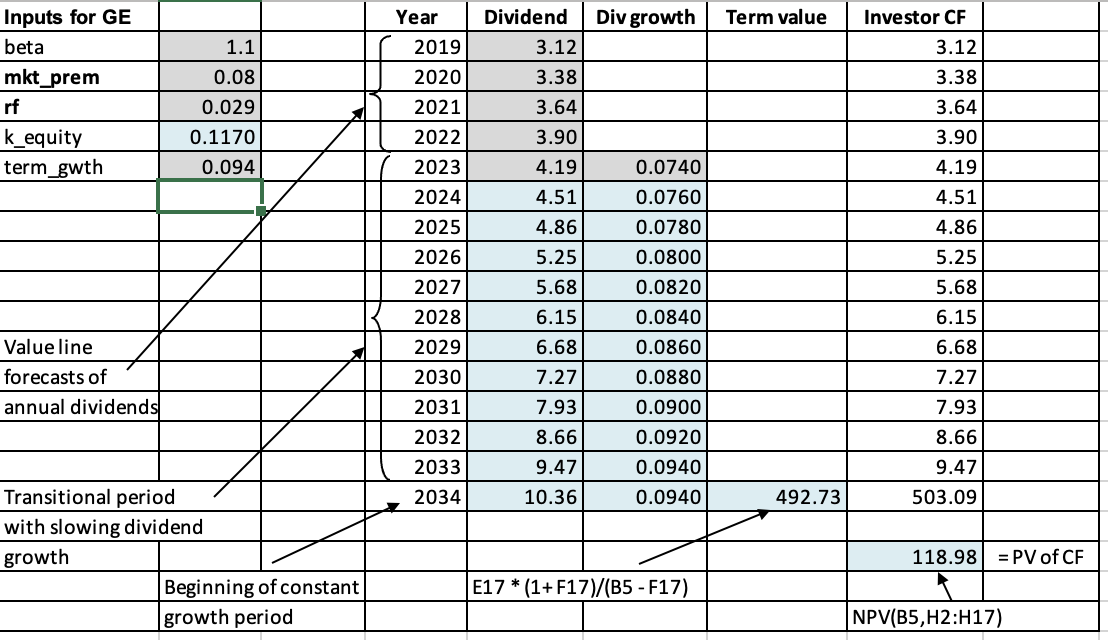

Calculate the intrinsic value of Rio Tinto in each of the following scenarios by using the three-stage growth model of Spreadsheet 18.1. Treat each scenario independently. a. The terminal growth rate will be 10.30%. (Round your answer to 2 decimal places.) b. Rio Tinto's actual beta is 1.05. (Round your answer to 2 decimal places.) c. The market risk premium is 9.50%. (Round your answer to 2 decimal places.) Calculate the intrinsic value of Rio Tinto in each of the following scenarios by using the three-stage growth model of Spreadsheet 18.1. Treat each scenario independently. a. The terminal growth rate will be 10.30%. (Round your answer to 2 decimal places.) b. Rio Tinto's actual beta is 1.05. (Round your answer to 2 decimal places.) c. The market risk premium is 9.50%. (Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts