Question: please answer completely, both part a and b Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to

please answer completely, both part a and b

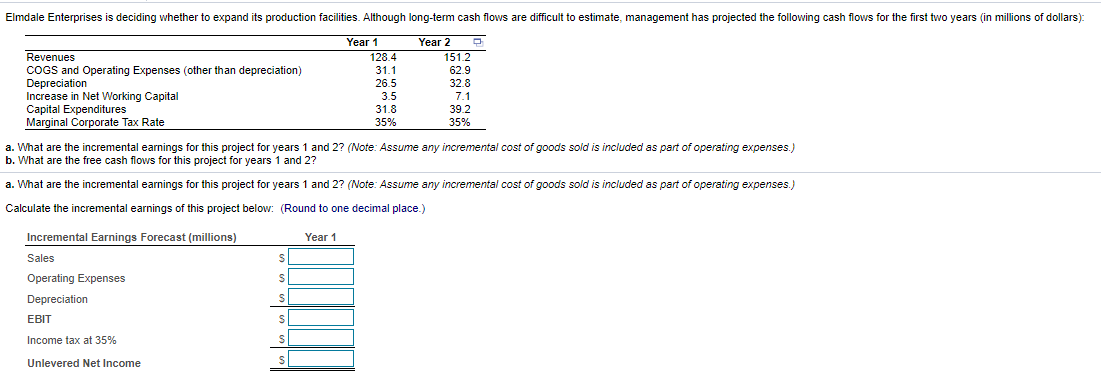

Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars): Revenues COGS and Operating Expenses (other than depreciation) Depreciation Increase in Net Working Capital Capital Expenditures Marginal Corporate Tax Rate Year 1 128.4 31.1 26.5 3.5 31.8 35% Year 2 151.2 62.9 32.8 7.1 39.2 35% a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.) b. What are the free cash flows for this project for years 1 and 2? a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.) Calculate the incremental earnings of this project below: (Round to one decimal place.) Year 1 S Incremental Earnings Forecast (millions) Sales Operating Expenses Depreciation EBIT S S S Income tax at 35% S Unlevered Net Income s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts