Question: Please answer completely for good feedback The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of the face value): 3

Please answer completely for good feedback

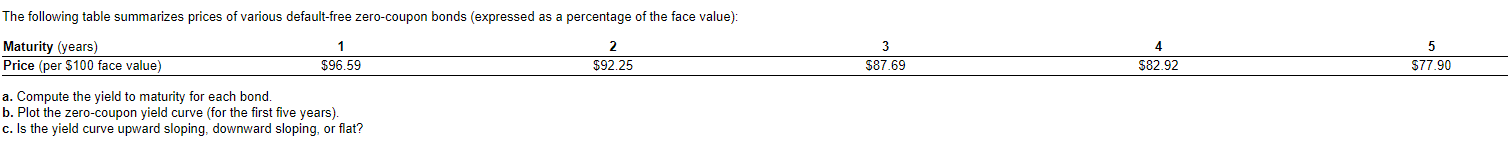

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of the face value): 3 Maturity (years) Price (per $100 face value) 1 $96.59 $87.69 4 $82.92 $92.25 5 $77.90 a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years). c. Is the yield curve upward sloping, downward sloping, or flat

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts