Question: please answer correct Q3. Retained earnings have no explicit cost, so these funds are free of cost.comment. A Company's present capital structure is Rs. Equity

please answer correct

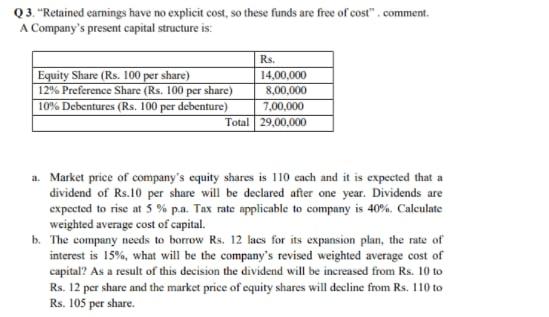

Q3. "Retained earnings have no explicit cost, so these funds are free of cost".comment. A Company's present capital structure is Rs. Equity Share (Rs. 100 per share) 14,00,000 12% Preference Share (Rs. 100 per share) 8,00,000 10% Debentures (Rs. 100 per debenture) Total 29,00,000 7,00.000 Market price of company's equity shares is 110 cach and it is expected that a dividend of Rs.10 per share will be declared after one year. Dividends are expected to rise at 5 % pa Tax rate applicable to company is 40%. Calculate weighted average cost of capital . b. The company needs to borrow Rs. 12 lacs for its expansion plan, the rate of interest is 15%, what will be the company's revised weighted average cost of capital? As a result of this decision the dividend will be increased from Rs. 10 to Rs. 12 per share and the market price of equity shares will decline from Rs. 110 to Rs. 105 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts