Question: please answer correct Q4. Is there an optimal capital structure as per NOI approach? Explain. A company's current operating income is Rs. 6,00,000. The firm

please answer correct

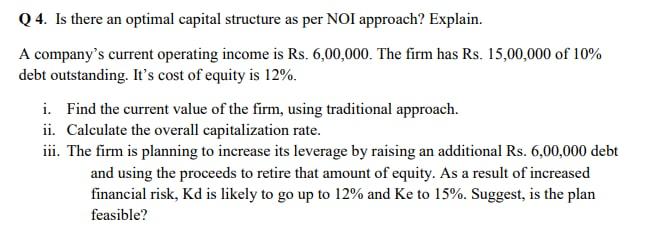

Q4. Is there an optimal capital structure as per NOI approach? Explain. A company's current operating income is Rs. 6,00,000. The firm has Rs. 15,00,000 of 10% debt outstanding. It's cost of equity is 12%. i. Find the current value of the firm, using traditional approach. ii. Calculate the overall capitalization rate. ii. The firm is planning to increase its leverage by raising an additional Rs. 6,00,000 debt and using the proceeds to retire that amount of equity. As a result of increased financial risk, Kd is likely to go up to 12% and Ke to 15%. Suggest, is the plan feasible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts