Question: please answer correct solution ill give u like only if its correct A borrower has a 5/1 ARM tied to the 1 -Year London Interbank

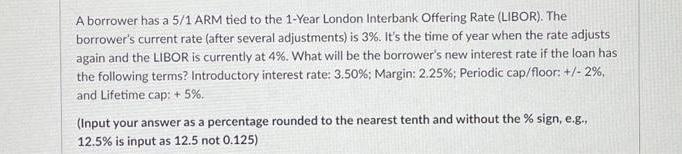

A borrower has a 5/1 ARM tied to the 1 -Year London Interbank Offering Rate (LIBOR). The borrower's current rate (after several adjustments) is 3%. It's the time of year when the rate adjusts again and the LIBOR is currently at 4%. What will be the borrower's new interest rate if the loan has the following terms? Introductory interest rate: 3.50%; Margin: 2.25%; Periodic cap/floor: +12%, and Lifetime cap: +5%. (Input your answer as a percentage rounded to the nearest tenth and without the \% sign, e.g., 12.5% is input as 12.5 not 0.125 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts