Question: Please answer correct with good presentation , its a very important question for me Note : use commas and dollar sign in each figure Record

Please answer correct with good presentation , its a very important question for me

Note : use commas and dollar sign in each figure

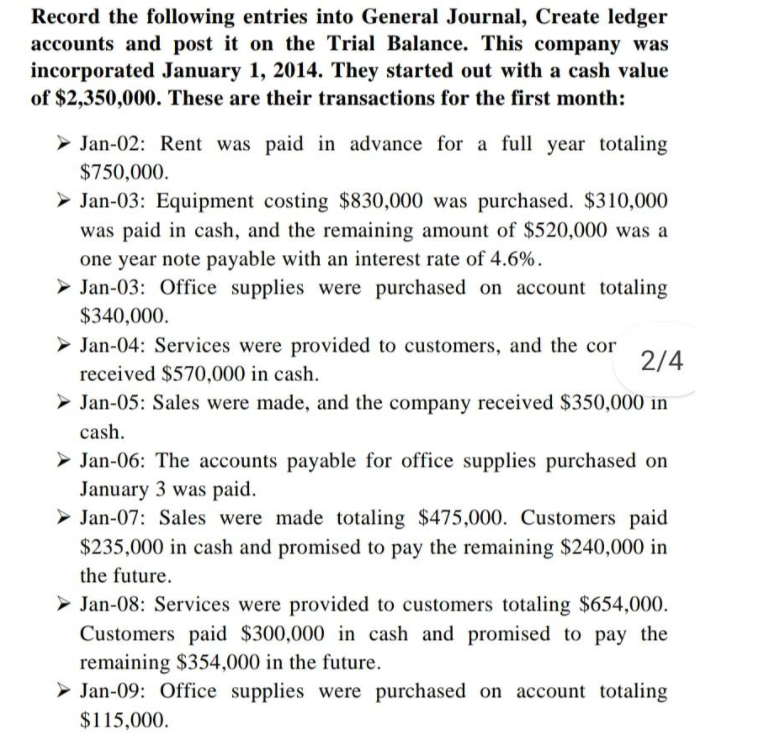

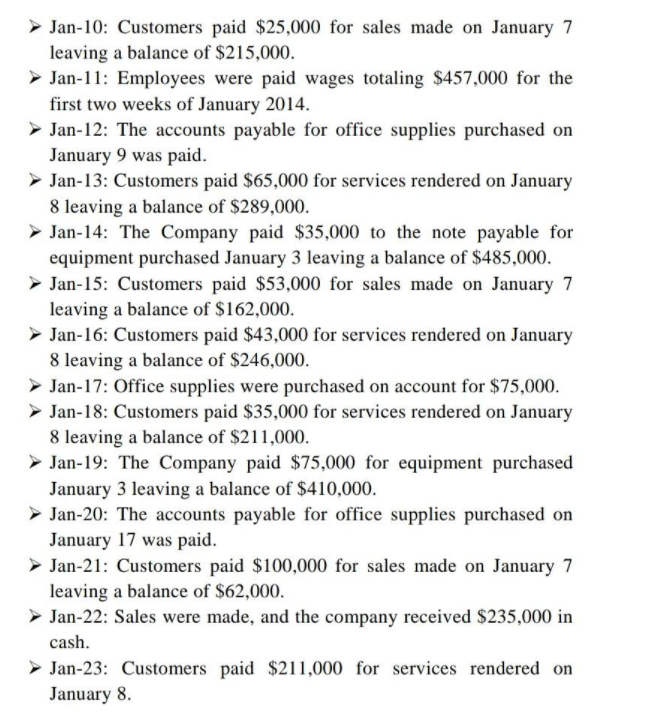

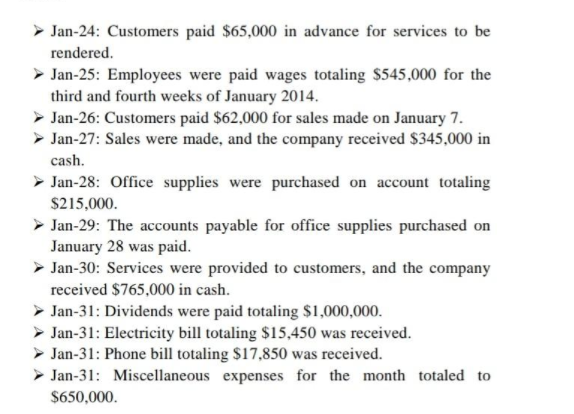

Record the following entries into General Journal, Create ledger accounts and post it on the Trial Balance. This company was incorporated January 1, 2014. The}r started out with a cash value of $2,350,000. These are their transactions for the rst month: 3' Ian-02: Rent was paid in advance for a full year totaling $750,000. ii Jan-03: Equipment costing $830,000 was purchased. $310,000 was paid in cash, and the remaining amount of $520,000 was a one year note payable with an interest rate of 4.6%. 'P Jan-03: Ofce supplies were purchased on account totaling $340,000. P Ian-04: Services were provided to customers. and the cor received $5'?0,000 in cash. 2'\"! )ir Ian-05: Sales were made, and the company received $350,000 in cash. '9 Jan-06: The accounts payable for office supplies purchased on January 3 was paid. 3* Jan-07: Sales were made totaling $475,000. Customers paid $235,000 in cash and promised to pay the remaining $240,000 in the future. 3 Jan-08: Services were provided to customers totaling $654,000. Customers paid $300,000 in cash and promised to pay the remaining $354,000 in the future. it Jan-09: Ofce supplies were purchased on account totaling $115,000. > Jan-10: Customers paid $25,000 for sales made on January 7 leaving a balance of $215,000. > Jan-11: Employees were paid wages totaling $457,000 for the first two weeks of January 2014. Jan-12: The accounts payable for office supplies purchased on January 9 was paid. > Jan-13: Customers paid $65,000 for services rendered on January 8 leaving a balance of $289,000. > Jan-14: The Company paid $35,000 to the note payable for equipment purchased January 3 leaving a balance of $485,000. Jan-15: Customers paid $53,000 for sales made on January 7 leaving a balance of $162,000. Jan-16: Customers paid $43,000 for services rendered on January 8 leaving a balance of $246,000. >Jan-17: Office supplies were purchased on account for $75,000. > Jan-18: Customers paid $35,000 for services rendered on January 8 leaving a balance of $211,000. > Jan-19: The Company paid $75,000 for equipment purchased January 3 leaving a balance of $410,000. >Jan-20: The accounts payable for office supplies purchased on January 17 was paid. >Jan-21: Customers paid $100,000 for sales made on January 7 leaving a balance of $62,000. >Jan-22: Sales were made, and the company received $235,000 in cash. Jan-23: Customers paid $211,000 for services rendered on January 8.Jan-24: Customers paid $65,000 in advance for services to be rendered. Jan-25: Employees were paid wages totaling $545,000 for the third and fourth weeks of January 2014. > Jan-26: Customers paid $62,000 for sales made on January 7. Jan-27: Sales were made, and the company received $345,000 in cash. Jan-28: Office supplies were purchased on account totaling $215,000. Jan-29: The accounts payable for office supplies purchased on January 28 was paid. Jan-30: Services were provided to customers, and the company received $765,000 in cash. Jan-31: Dividends were paid totaling $1,000,000. Jan-31: Electricity bill totaling $15,450 was received. Jan-31: Phone bill totaling $17,850 was received. Jan-31: Miscellaneous expenses for the month totaled to $650,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts