Question: please answer correctly and highlight the answer!! also explain... huge part of my grade thanks Using information from the Q1 What is the value of

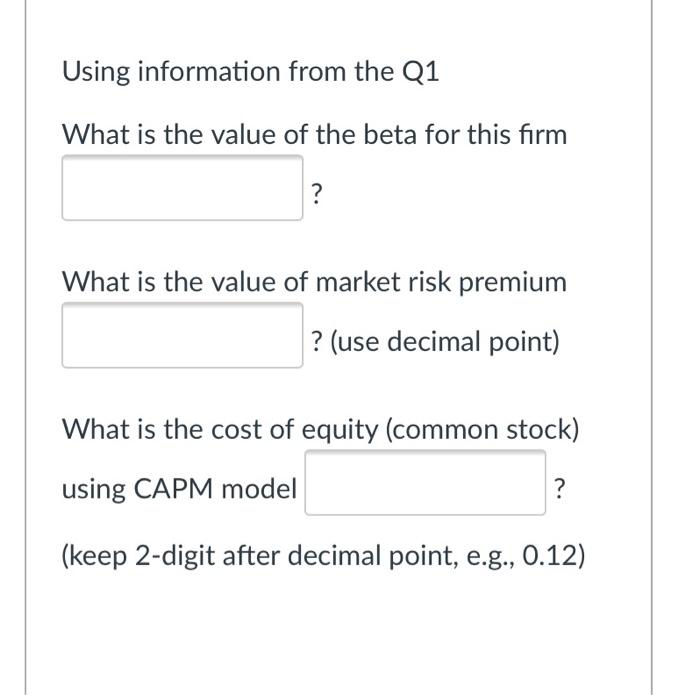

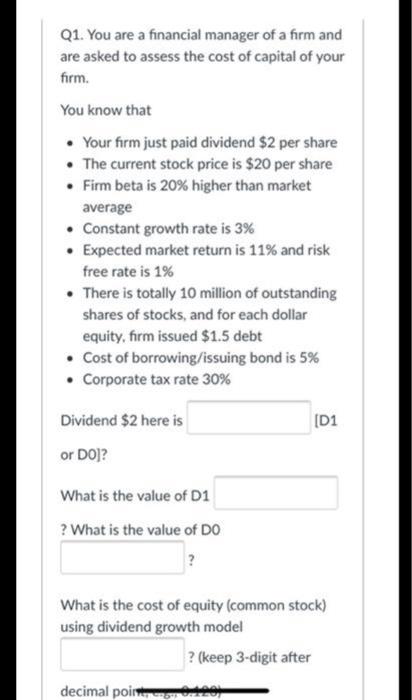

Using information from the Q1 What is the value of the beta for this firm ? What is the value of market risk premium ? (use decimal point) What is the cost of equity (common stock) using CAPM model ? (keep 2-digit after decimal point, e.g., 0.12) Q1. You are a financial manager of a firm and are asked to assess the cost of capital of your firm. You know that Your firm just paid dividend $2 per share The current stock price is $20 per share Firm beta is 20% higher than market average Constant growth rate is 3% Expected market return is 11% and risk free rate is 1% There is totally 10 million of outstanding shares of stocks, and for each dollar equity, firm issued $1.5 debt Cost of borrowing/issuing bond is 5% Corporate tax rate 30% [D1 Dividend $2 here is or DO? What is the value of D1 ? What is the value of DO What is the cost of equity (common stock) using dividend growth model ? (keep 3-digit after decimal pointment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts