Question: PLEASE ANSWER CORRECTLY ASAP I. What general observations can be made regarding tax systems in general and the Rodosian tax code? A. In general, there

PLEASE ANSWER CORRECTLY ASAP

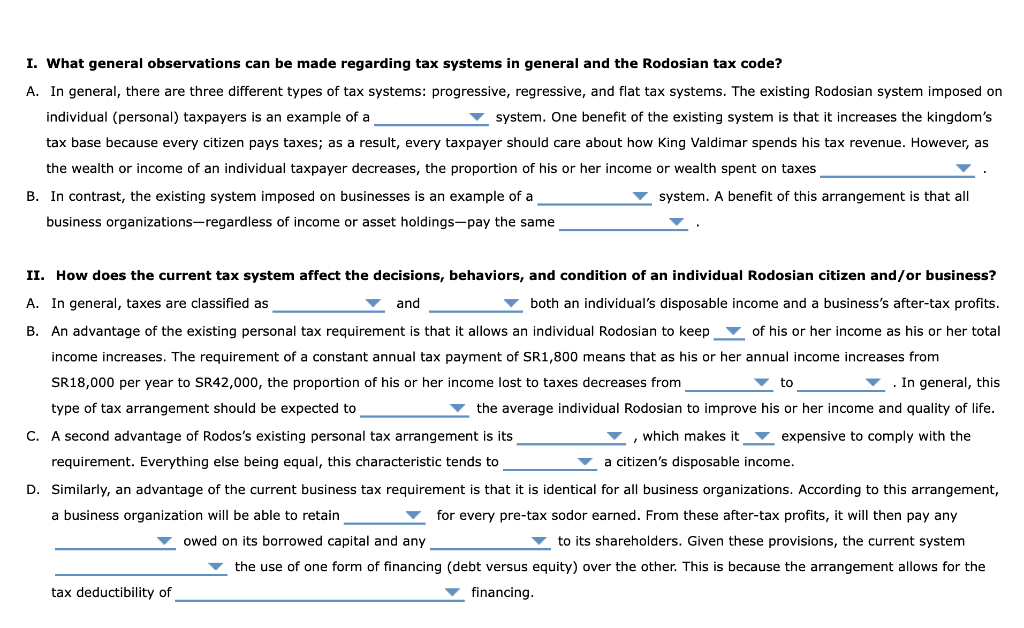

I. What general observations can be made regarding tax systems in general and the Rodosian tax code? A. In general, there are three different types of tax systems: progressive, regressive, and flat tax systems. The existing Rodosian system imposed the wealth or income of an individual taxpayer decreases, the proportion of his or her income or wealth spent on taxes B. In contrast, the existing system imposed on businesses is an example of a system. A benefit of this arrangement is that business organizations-regardless of income or asset holdings-pay the same II. How does the current tax system affect the decisions, behaviors, and condition of an individual Rodosizen A. In general, taxes are classified as and both an individual's disposable income and a business's after-tax profits. SR18,000 per year to SR42,000, the proportion of his or her income lost to taxes decreases from this C. A second advantage of Rodos's existing personal tax arrangement is its, which makes it mith the requirement. Everything else being equal, this characteristic tends to a citizen's disposable income. a business organization will be able to retain for every pre-tax sodor earned. From these after-tax profits, it then pay any owed on its borrowed capital and any. to its shareholders. Given these provisions, the current system the use of one form of financing (debt versus equity) over the other. This is because the arrangement allows for the tax deductibility of financing. I. What general observations can be made regarding tax systems in general and the Rodosian tax code? A. In general, there are three different types of tax systems: progressive, regressive, and flat tax systems. The existing Rodosian system imposed the wealth or income of an individual taxpayer decreases, the proportion of his or her income or wealth spent on taxes B. In contrast, the existing system imposed on businesses is an example of a system. A benefit of this arrangement is that business organizations-regardless of income or asset holdings-pay the same II. How does the current tax system affect the decisions, behaviors, and condition of an individual Rodosizen A. In general, taxes are classified as and both an individual's disposable income and a business's after-tax profits. SR18,000 per year to SR42,000, the proportion of his or her income lost to taxes decreases from this C. A second advantage of Rodos's existing personal tax arrangement is its, which makes it mith the requirement. Everything else being equal, this characteristic tends to a citizen's disposable income. a business organization will be able to retain for every pre-tax sodor earned. From these after-tax profits, it then pay any owed on its borrowed capital and any. to its shareholders. Given these provisions, the current system the use of one form of financing (debt versus equity) over the other. This is because the arrangement allows for the tax deductibility of financing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts