Question: Please answer correctly i will give a thumbs up . If wrong i will put a thumbs down and reprt so please be accurate Required

Please answer correctly i will give a thumbs up If wrong i will put a thumbs down and reprt so please be accurate Required information

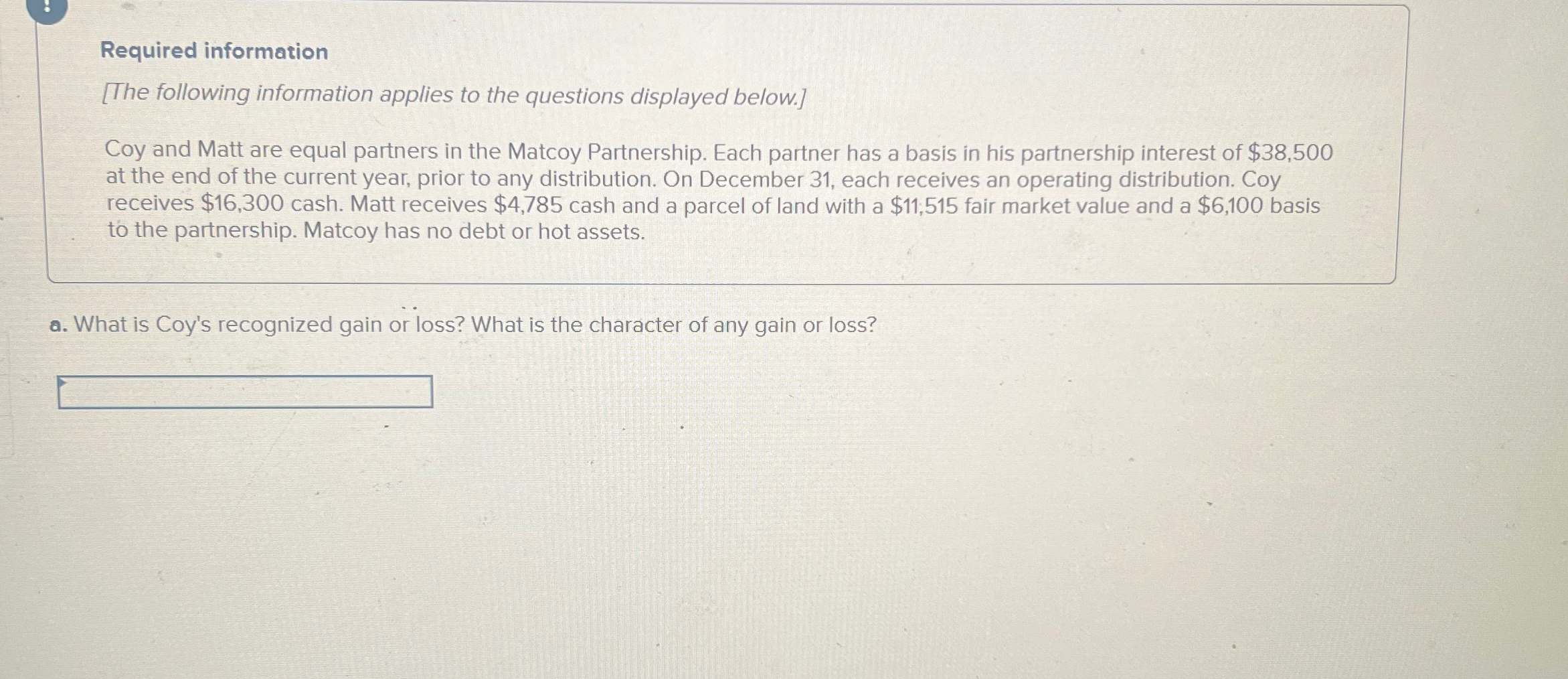

The following information applies to the questions displayed below.

Coy and Matt are equal partners in the Matcoy Partnership. Each partner has a basis in his partnership interest of $ at the end of the current year, prior to any distribution. On December each receives an operating distribution. Coy receives $ cash. Matt receives $ cash and a parcel of land with a $ fair market value and a $ basis to the partnership. Matcoy has no debt or hot assets.

a What is Coy's recognized gain or loss? What is the character of any gain or loss?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock