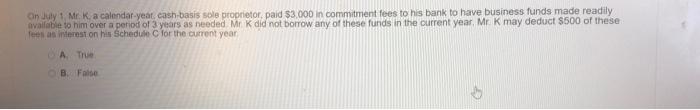

Question: please answer correctly On July 1 Mr. K. a calendar-year cash basis sole proprietor, paid $3.000 in commitment fees to his bank to have business

On July 1 Mr. K. a calendar-year cash basis sole proprietor, paid $3.000 in commitment fees to his bank to have business funds made readily available to him over a period of 3 years as needed Mr. K did not borrow any of these funds in the current year Mr. K may deduct $500 of these les as interest on his Schedule for the current year A The B. Fale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts