Question: Please Answer correctly please i cant figure out the rest Saved inment North Wind Aviation received its charter during January authorizing the following capital stock:

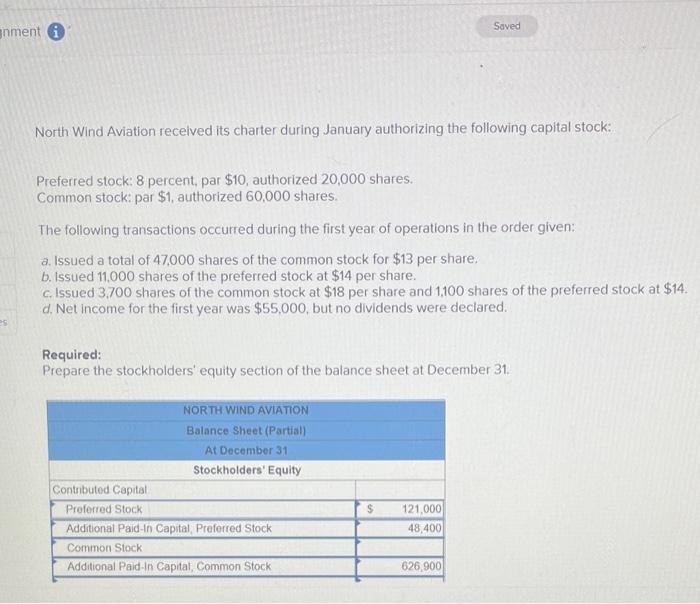

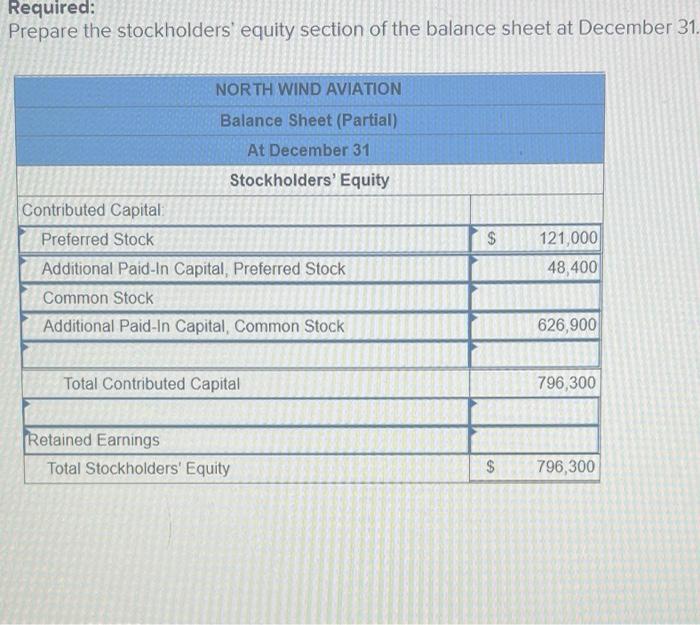

Saved inment North Wind Aviation received its charter during January authorizing the following capital stock: Preferred stock: 8 percent, par $10, authorized 20,000 shares. Common stock: par $1, authorized 60,000 shares. The following transactions occurred during the first year of operations in the order given: a. Issued a total of 47.000 shares of the common stock for $13 per share. b. Issued 11.000 shares of the preferred stock at $14 per share. c. Issued 3.700 shares of the common stock at $18 per share and 1100 shares of the preferred stock at $14. d. Net Income for the first year was $55,000, but no dividends were declared. Required: Prepare the stockholders' equity section of the balance sheet at December 31 NORTH WIND AVIATION Balance Sheet (Partial At December 31 Stockholders' Equity Contributed Capital Preferred Stock Additional Paid In Capital Preferred Stock Common Stock Additional Paid In Capital, Common Stock 121,000 48,400 626,900 Required: Prepare the stockholders' equity section of the balance sheet at December 31 NORTH WIND AVIATION Balance Sheet(Partial) At December 31 Stockholders' Equity Contributed Capital: Preferred Stock Additional Paid-In Capital, Preferred Stock Common Stock Additional Paid-In Capital, Common Stock $ 121,000 48,400 626,900 Total Contributed Capital 796,300 Retained Earnings Total Stockholders' Equity $ 796,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts