Question: please answer correctly Question Completion Status: Close Window Question 1 of 20 A Moving to another question will save this response. Question 1 1 points

please answer correctly

please answer correctly

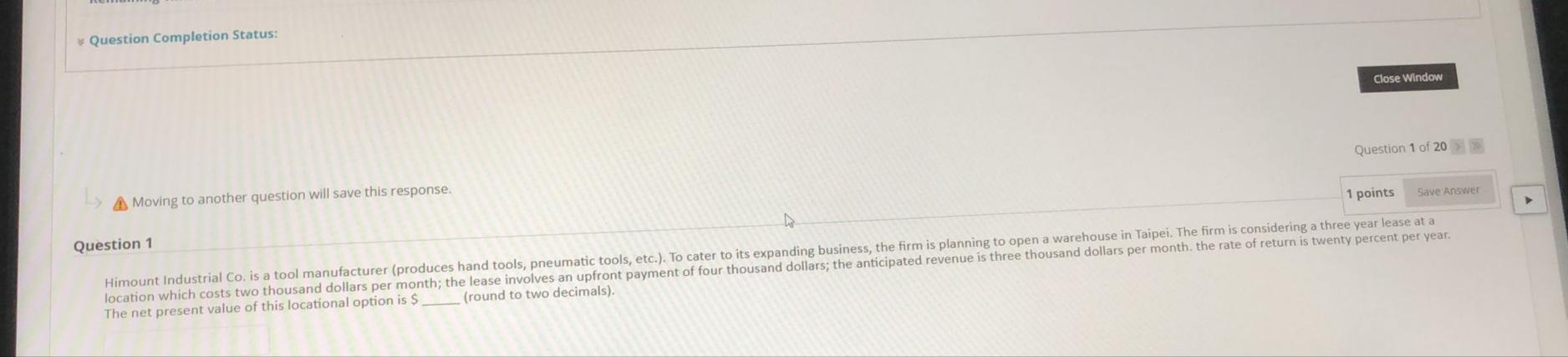

Question Completion Status: Close Window Question 1 of 20 A Moving to another question will save this response. Question 1 1 points Save Answer Himount Industrial Co. is a tool manufacturer (produces hand tools, pneumatic tools, etc.). To cater to its expanding business, the firm is planning to open a warehouse in Taipei. The firm is considering a three year lease at a location which costs two thousand dollars per month; the lease involves an upfront payment of four thousand dollars; the anticipated revenue is three thousand dollars per month, the rate of return is twenty percent per year. The net present value of this locational option is $ (round to two decimals)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts