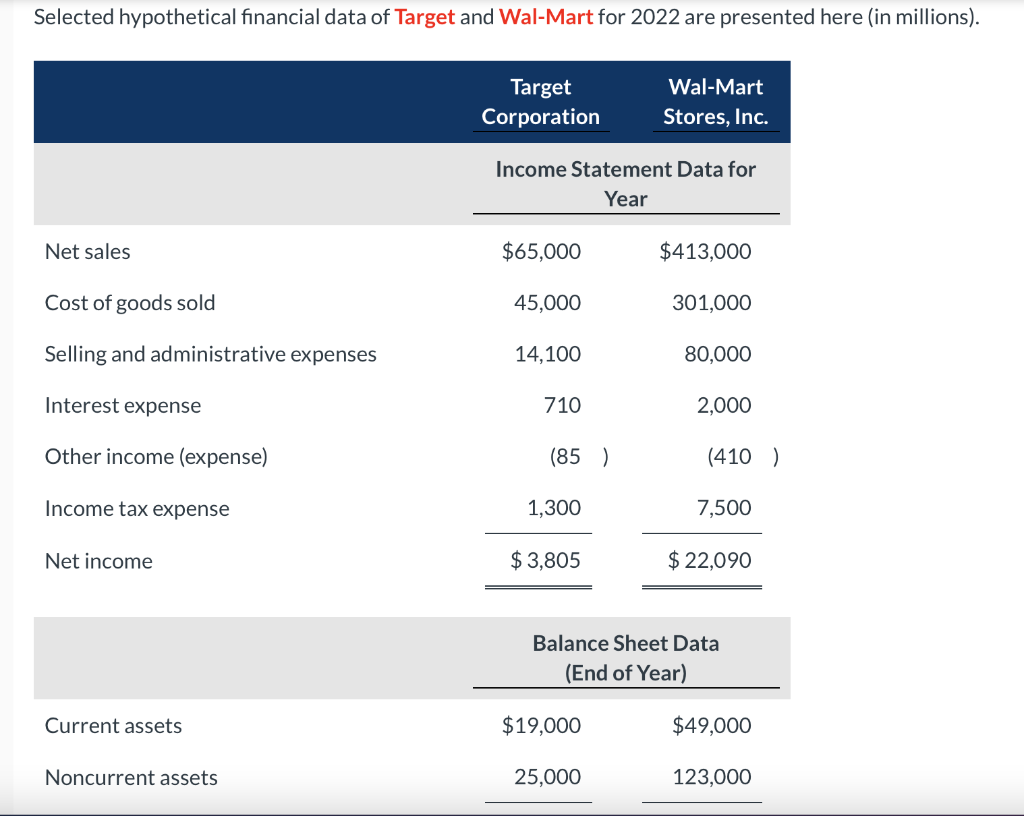

Question: Please answer correctly! Selected hypothetical financial data of Target and Wal-Mart for 2022 are presented here (in millions). Balance Sheet Data (End of Year) Current

Please answer correctly!

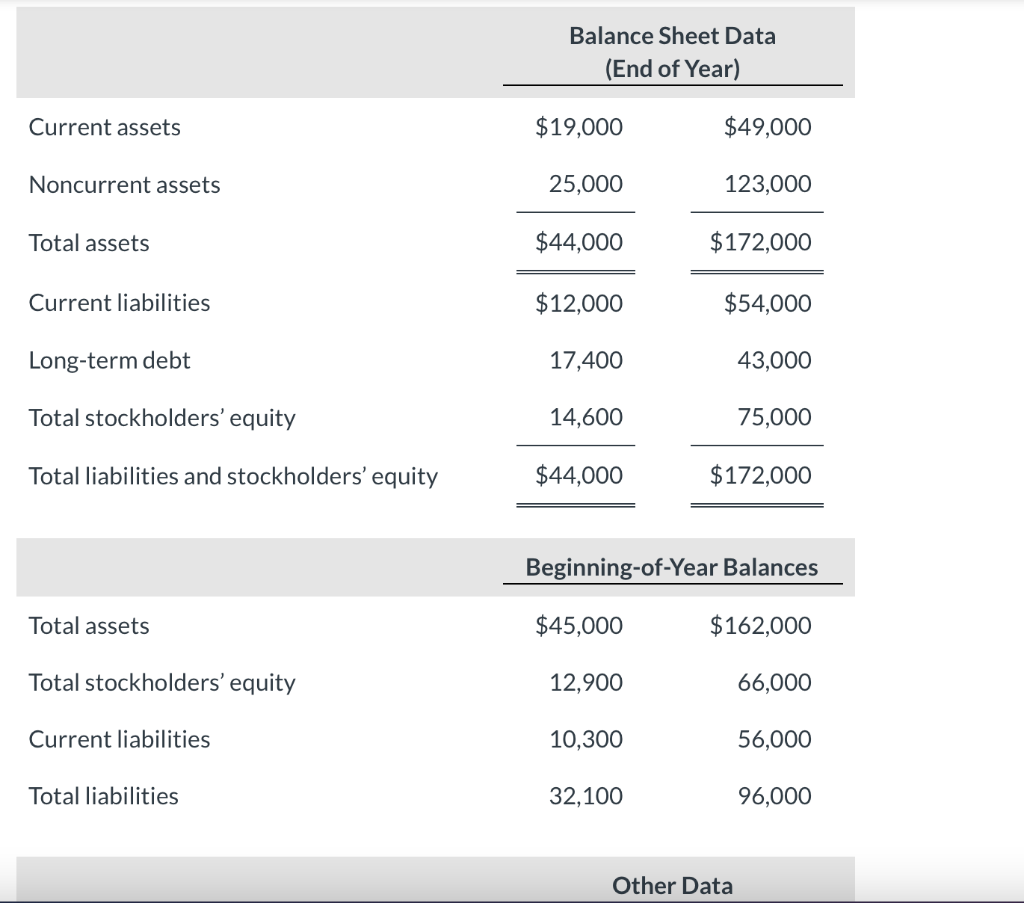

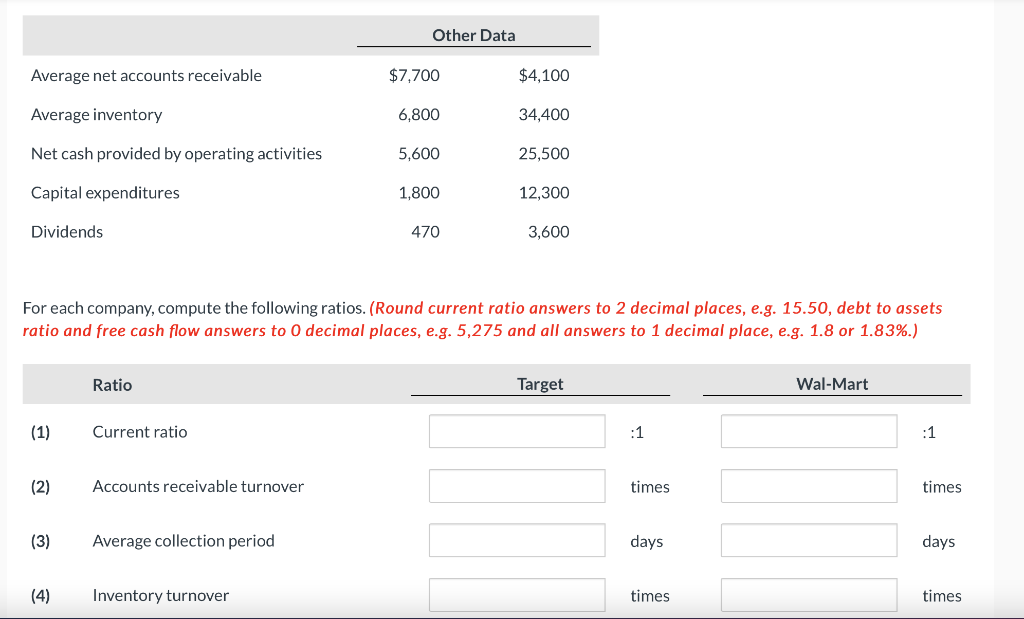

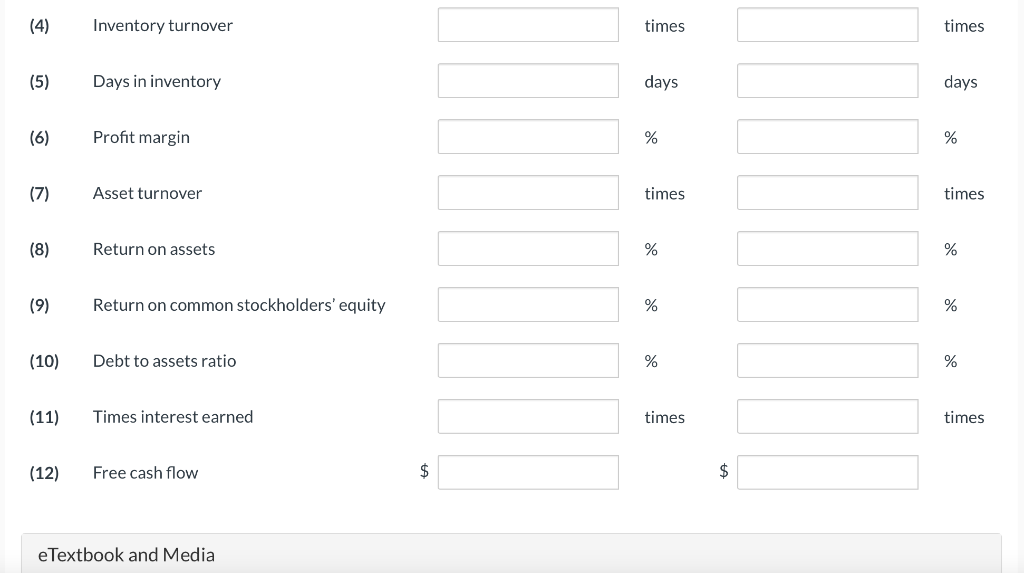

Selected hypothetical financial data of Target and Wal-Mart for 2022 are presented here (in millions). Balance Sheet Data (End of Year) Current assets $19,000$49,000 Noncurrent assets Total assets Current liabilities \( \frac{25,000}{\$ 44,000} \quad \frac{123,000}{} \quad \stackrel{\$ 54,000}{\hline} \) Long-term debt Total stockholders' equity Total liabilities and stockholders' equity Total assets $45,000$162,000 Total stockholders' equity 12,90066,000 Current liabilities 10,30056,000 Total liabilities 32,10096,000 Other Data For each company, compute the following ratios. (Round current ratio answers to 2 decimal places, e.g. 15.50, debt to assets ratio and free cash flow answers to 0 decimal places, e.g. 5,275 and all answers to 1 decimal place, e.g. 1.8 or 1.83%. (4) Inventory turnover times times (5) Days in inventory days days (6) Profit margin % % (7) Asset turnover times times (8) Return on assets % % (9) Return on common stockholders' equity % % (10) Debt to assets ratio % % (11) Times interest earned times times (12) Free cash flow $ $ eTextbook and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts