Question: please answer correctly using proper calculations and explanations. Assume a fiscal year-end of September 30. Compute the annual depreciation charges over the asset's life applying

please answer correctly using proper calculations and explanations.

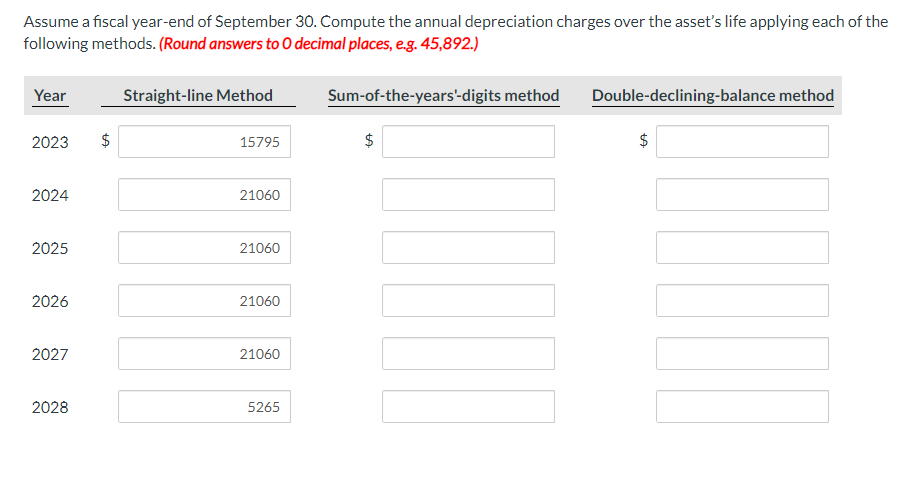

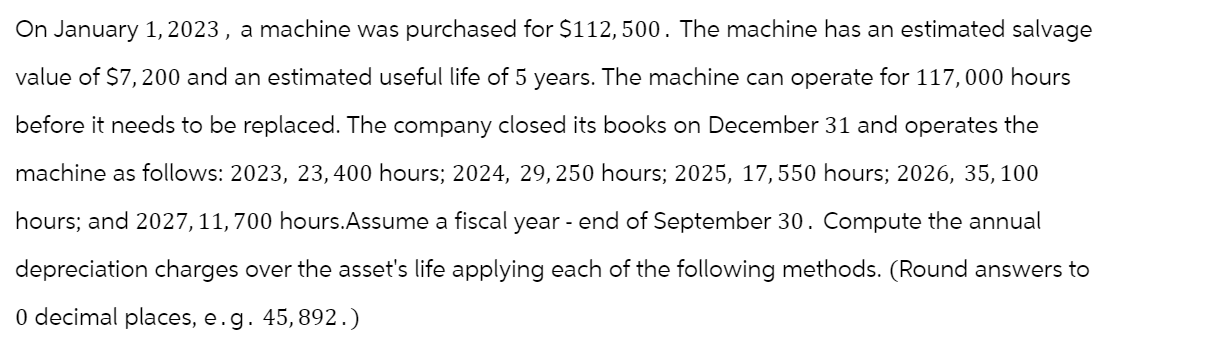

Assume a fiscal year-end of September 30. Compute the annual depreciation charges over the asset's life applying each of the following methods. (Round answers to O decimal places, e.g. 45,892.) Year Straight-line Method Sum-of-the-years'-digits method Double-declining-balance method 2023 15795 2024 21060 2025 21060 2026 21060 2027 21060 2028 5265On January 1, 2023, a machine was purchased for $112, 500. The machine has an estimated salvage value of S7, 200 and an estimated useful life of 5 years. The machine can operate for 117, 000 hours before it needs to be replaced. The company closed its books on December 31 and operates the machine as follows: 2023, 23,400 hours; 2024, 29,250 hours; 2025, 17, 550 hours; 2026, 35,100 hours; and 2027, 11, 700 hoursAssume a fiscal year - end of September 30. Compute the annual depreciation charges over the asset's life applying each of the following methods. (Round answers to 0 decimal places, e.g. 45, 892.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts