Question: PLEASE ANSWER (D) , & (E). [A, B, C has been answered in this link: https://www.chegg.com/homework-help/questions-and-answers/question-1-total-50-marks-kerusi-sdn-bhd-manufactures-2-types-chairs-type-without-arm-rest-q92848653 ] Question 1 [Total 50 marks] Kerusi Sdn Bhd

PLEASE ANSWER (D) , & (E). [A, B, C has been answered in this link: https://www.chegg.com/homework-help/questions-and-answers/question-1-total-50-marks-kerusi-sdn-bhd-manufactures-2-types-chairs-type-without-arm-rest-q92848653 ]

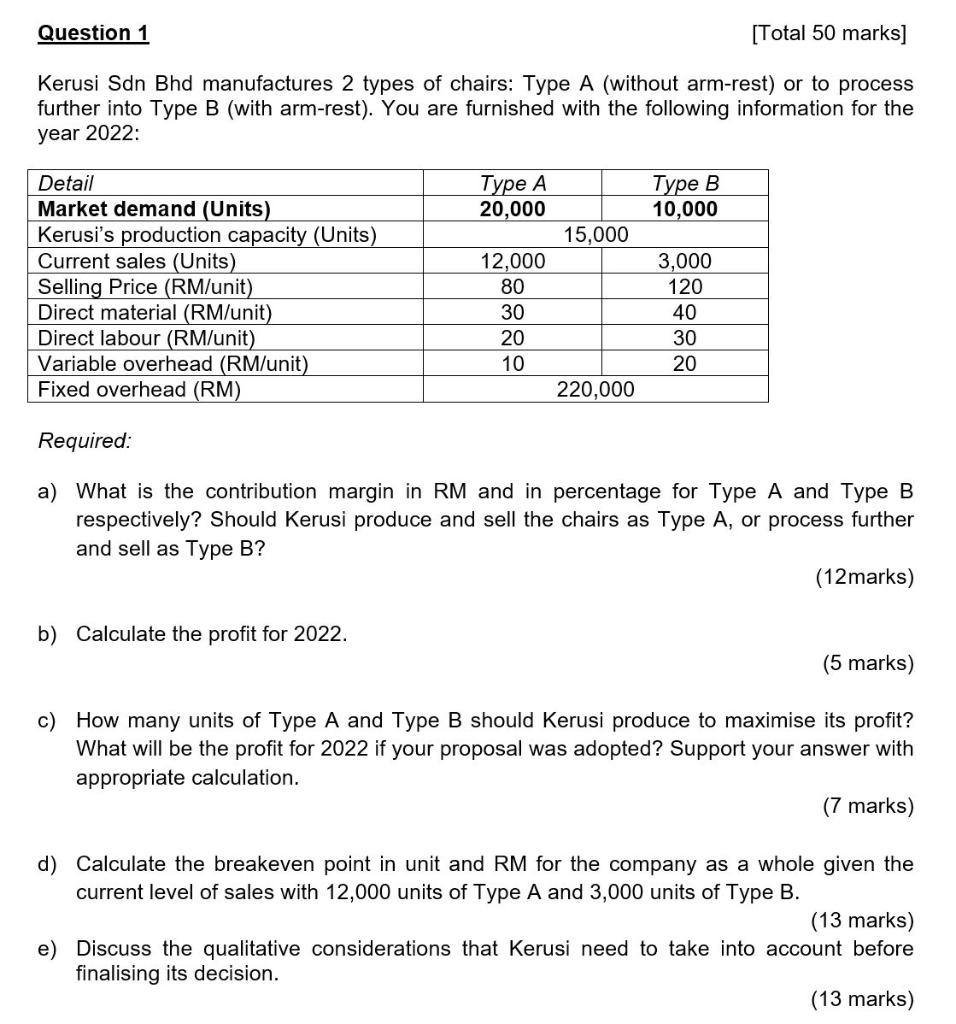

Question 1 [Total 50 marks] Kerusi Sdn Bhd manufactures 2 types of chairs: Type A (without arm-rest) or to process further into Type B (with arm-rest). You are furnished with the following information for the year 2022: Type B 10,000 Detail Market demand (Units) Kerusi's production capacity (Units) Current sales (Units) Selling Price (RM/unit) Direct material (RM/unit) Direct labour (RM/unit) Variable overhead (RM/unit) Fixed overhead (RM) Type A 20,000 15,000 12,000 80 30 20 10 220,000 3,000 120 40 30 20 Required: a) What is the contribution margin in RM and in percentage for Type A and Type B respectively? Should Kerusi produce and sell the chairs as Type A, or process further and sell as Type B? (12marks) b) Calculate the profit for 2022. (5 marks) c) How many units of Type A and Type B should Kerusi produce to maximise its profit? What will be the profit for 2022 if your proposal was adopted? Support your answer with appropriate calculation. (7 marks) d) Calculate the breakeven point in unit and RM for the company as a whole given the current level of sales with 12,000 units of Type A and 3,000 units of Type B. (13 marks) e) Discuss the qualitative considerations that Kerusi need to take into account before finalising its decision. (13 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts