Question: Please answer DeVry Student Portal X Week 6: Homework X CengageNOWv2 | Online teachin X + D agenow.com/ilm/takeAssignment/takeAssignmentMain.do?inprogress=true to Harry and Wei are married and

Please answer

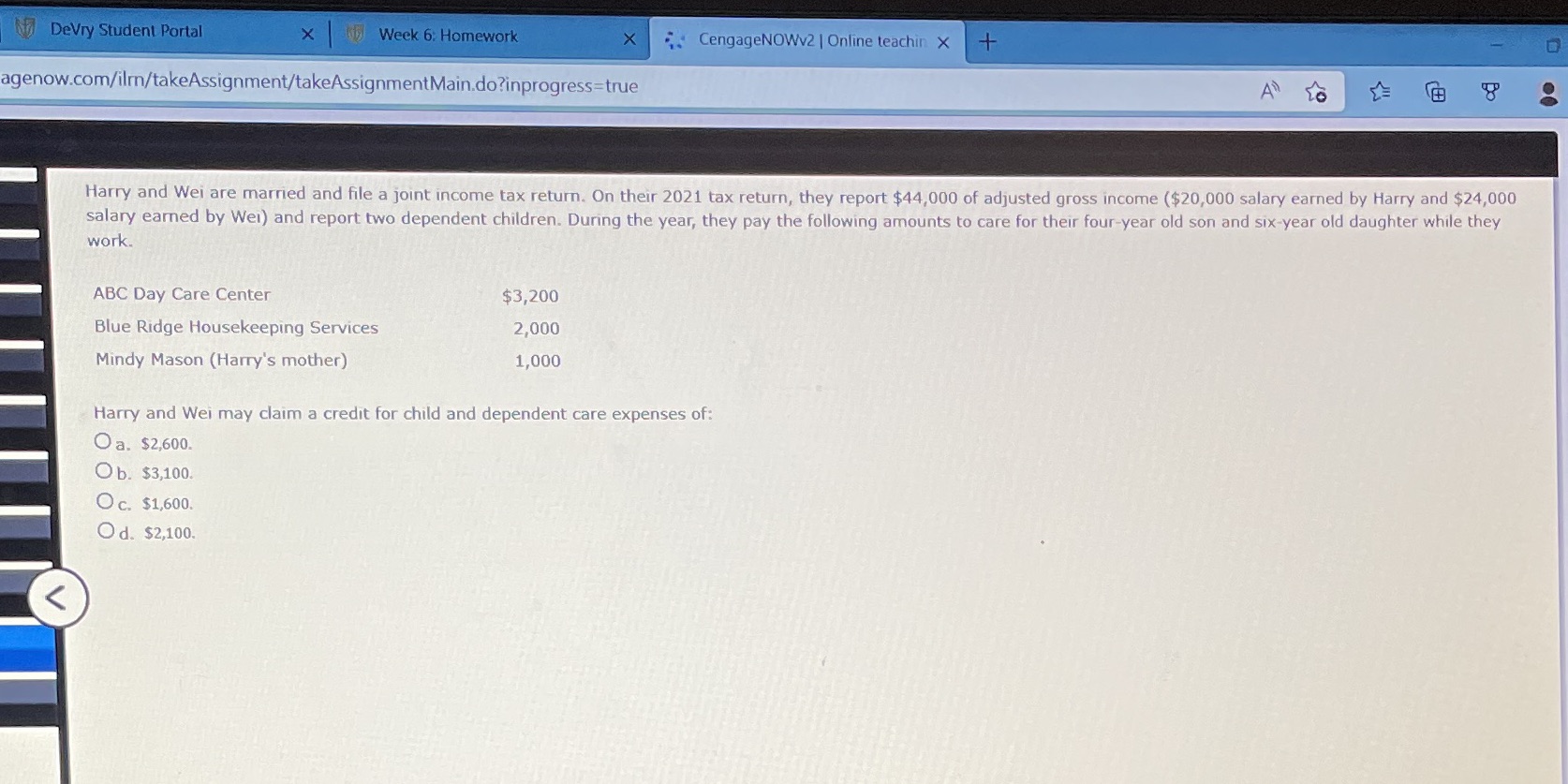

DeVry Student Portal X Week 6: Homework X CengageNOWv2 | Online teachin X + D agenow.com/ilm/takeAssignment/takeAssignmentMain.do?inprogress=true to Harry and Wei are married and file a joint income tax return. On their 2021 tax return, they report $44,000 of adjusted gross income ($20,000 salary earned by Harry and $24,000 salary earned by Wei) and report two dependent children. During the year, they pay the following amounts to care for their four-year old son and six-year old daughter while they work. ABC Day Care Center $3,200 Blue Ridge Housekeeping Services 2,000 Mindy Mason (Harry's mother) 1,000 Harry and Wei may claim a credit for child and dependent care expenses of: Oa. $2,600. Ob. $3,100. Oc. $1,600. Od. $2,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts