Question: Please answer E Merge Center $% Conditional Formatos Cell Chipboard Font Formatting ble Styles Alignment Number Age (in days) B D F G 1 (P-1)

Please answer

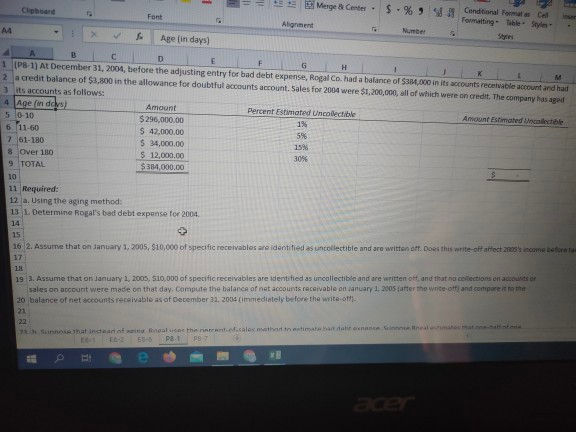

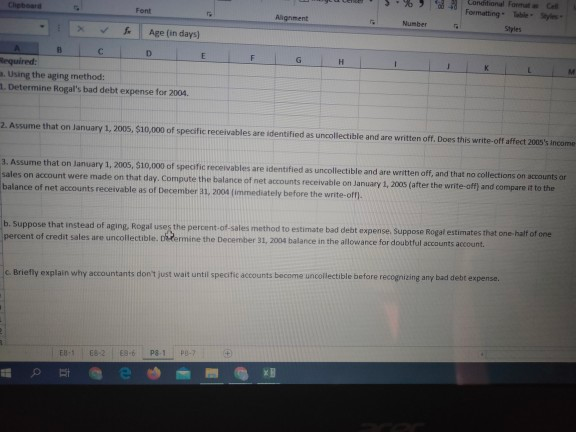

E Merge Center $% Conditional Formatos Cell Chipboard Font Formatting ble Styles Alignment Number Age (in days) B D F G 1 (P-1) At December 31, 2001, before the adjusting entry for bad debt expense, Rogal Co. had a balance of $3,000 in its accounts receivable account and had H 1 M 2 a credit balance of $3,800 in the allowance for doubtful accounts account. Sales for 2004 were $1,200,000, all of which were on credit. The company has aged 3 its accounts as follows: 4 Age (Indes) Amount Percent Estimated Uncollectible 50-10 Amount Estimated codech $296,000.00 1% 6 11-60 $ 42,000.00 5% 761-180 $ 34,000.00 15% 8 Over 180 $ 12,000.00 30% 9 TOTAL $384,000.00 $ 10 11 Required: 12 a. Using the aging method: 13 1. Determine Rogal's bad debt expense for 2004 14 15 16 2. Assume that on January 1, 2005, $10,000 of specific receivables are identified as uncollectible and are written off. Does this write-off affect 2005's income before 17 18 19 3. Assume that on January 1, 2005, $10,000 of specific receivables are identified as uncollectible and are written oft, and that no collections on accounts or sales on account were made on that day. Compute the balance of not accounts receivable on January 1, 2005 after the wnte oft) and compere it to the 20 balance of net accounts receivable as of December 31, 2004 (immediately before the write on 21 22 Since that intern sind nature the art of calamitadataimat EL EB PBT 5-7 Chebeard Font Alignment * Conditional Formal Formatting Styles Number Age (in days) E H 0 C D Required: . Using the aging method: 1. Determine Rogal's bad debt expense for 2004 M 2. Assume that on January 1, 2005, $10,000 of specific receivables are identified as uncollectible and are written off. Does this write-off affect 2005's income 3. Assume that on January 1, 2005, $10,000 of specific receivables are identified as uncollectible and are written off, and that no collections on accounts ar sales on account were made on that day. Compute the balance of net accounts receivable on January 1, 2005 (after the write-off) and compare it to the balance of net accounts receivable as of December 31, 2004 immediately before the write-off). b. Suppose that instead of aging. Rogal uses the percent-of-sales method to estimate bad debt expense Suppose Rogal estimates that one half of one percent of credit sales are uncollectible, termine the December 31, 2004 balance in the allowance for doubtful accounts account c. Briefly explain why accountants don't just wait until specific accounts become uncollectible before recognizing any bad debt expense. E81 18-2 ES P81 PO-2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts