Question: Please answer. E11-2 Identify qualitative characteristics. (LO 3) C Presented below are selected qualitative characteristics of financial information. 1. Relevance 2. Neutrality 3. Verifiability 4.

Please answer.

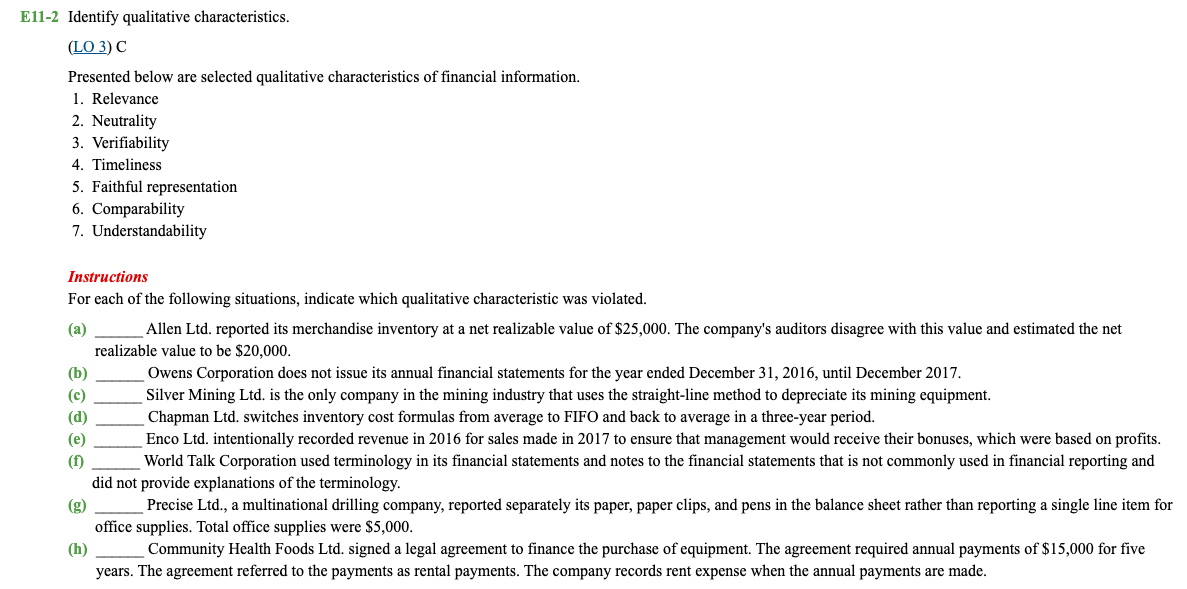

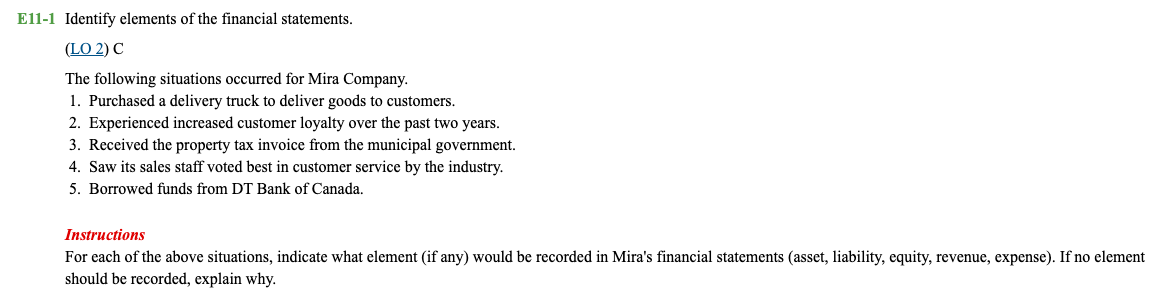

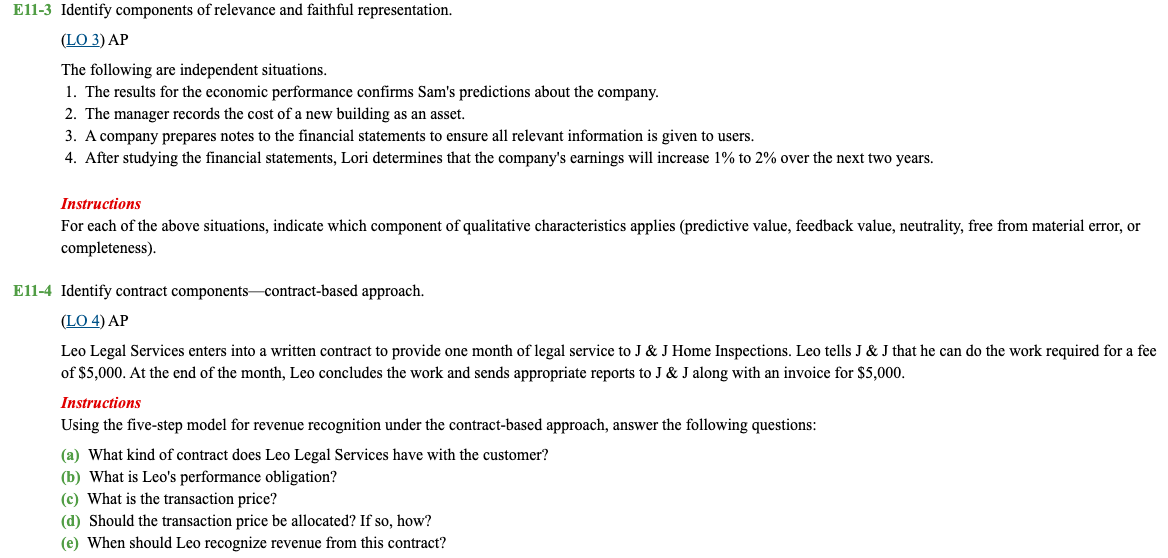

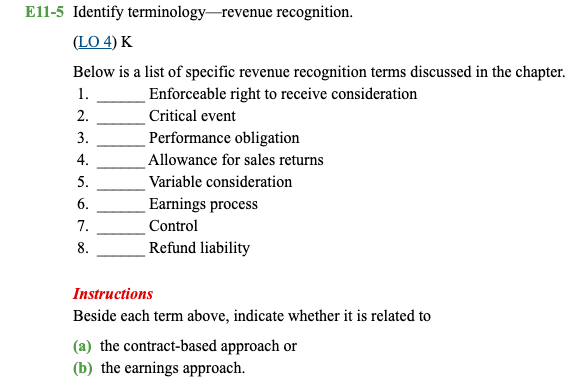

E11-2 Identify qualitative characteristics. (LO 3) C Presented below are selected qualitative characteristics of financial information. 1. Relevance 2. Neutrality 3. Verifiability 4. Timeliness 5. Faithful representation 6. Comparability 7. Understandability Instructions For each of the following situations, indicate which qualitative characteristic was violated. (a) Allen Ltd. reported its merchandise inventory at a net realizable value of $25,000. The company's auditors disagree with this value and estimated the net realizable value to be $20,000. (b) Owens Corporation does not issue its annual financial statements for the year ended December 31, 2016, until December 2017. (C) Silver Mining Ltd. is the only company in the mining industry that uses the straight-line method to depreciate its mining equipment. (d) Chapman Ltd. switches inventory cost formulas from average to FIFO and back to average in a three-year period. (e) Enco Lid. intentionally recorded revenue in 2016 for sales made in 2017 to ensure that management would receive their bonuses, which were based on profits. World Talk Corporation used terminology in its financial statements and notes to the financial statements that is not commonly used in financial reporting and did not provide explanations of the terminology. (g) Precise Ltd., a multinational drilling company, reported separately its paper, paper clips, and pens in the balance sheet rather than reporting a single line item for office supplies. Total office supplies were $5,000. (h) Community Health Foods Ltd. signed a legal agreement to finance the purchase of equipment. The agreement required annual payments of $15,000 for five years. The agreement referred to the payments as rental payments. The company records rent expense when the annual payments are made.El1-1 Identify elements of the financial statements. (LO 2) C The following situations occurred for Mira Company. 1. Purchased a delivery truck to deliver goods to customers. 2. Experienced increased customer loyalty over the past two years. 3. Received the property tax invoice from the municipal government. 4. Saw its sales staff voted best in customer service by the industry. 5. Borrowed funds from DT Bank of Canada. Instructions For each of the above situations, indicate what element (if any) would be recorded in Mira's financial statements (asset, liability, equity, revenue, expense). If no element should be recorded, explain why.E11-3 Identify components of relevance and faithful representation. (LO 3) AP The following are independent situations. 1. The results for the economic performance confirms Sam's predictions about the company. 2. The manager records the cost of a new building as an asset. 3. A company prepares notes to the financial statements to ensure all relevant information is given to users. 4. After studying the financial statements, Lori determines that the company's earnings will increase 1% to 2% over the next two years. Instructions For each of the above situations, indicate which component of qualitative characteristics applies (predictive value, feedback value, neutrality, free from material error, or completeness). E11-4 Identify contract components-contract-based approach. (LO 4) AP Leo Legal Services enters into a written contract to provide one month of legal service to J & J Home Inspections. Leo tells J & J that he can do the work required for a fee of $5,000. At the end of the month, Leo concludes the work and sends appropriate reports to J & J along with an invoice for $5,000. Instructions Using the five-step model for revenue recognition under the contract-based approach, answer the following questions: (a) What kind of contract does Leo Legal Services have with the customer? What is Leo's performance obligation? (c) What is the transaction price? (d) Should the transaction price be allocated? If so, how? (e) When should Leo recognize revenue from this contract?El1-5 Identify terminology-revenue recognition. (LO 4) K Below is a list of specific revenue recognition terms discussed in the chapter. 1. Enforceable right to receive consideration Critical event Performance obligation Allowance for sales returns Variable consideration Earnings process Control Refund liability Instructions Beside each term above, indicate whether it is related to (a) the contract-based approach or (b) the earnings approach