Question: please answer each one Gas and Gas Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Summary Financial

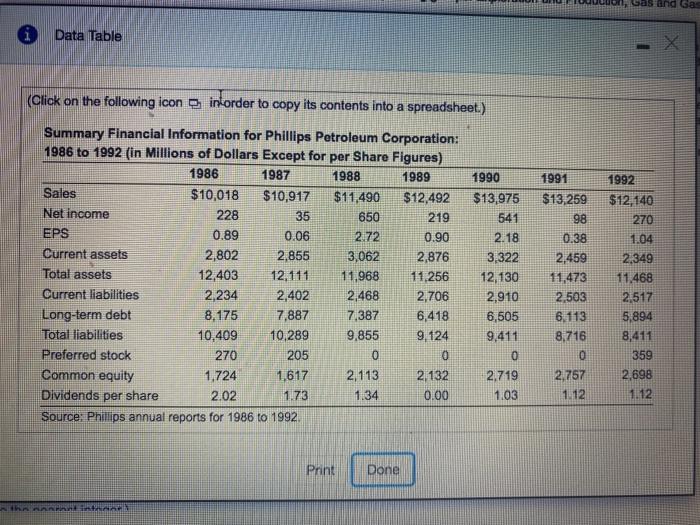

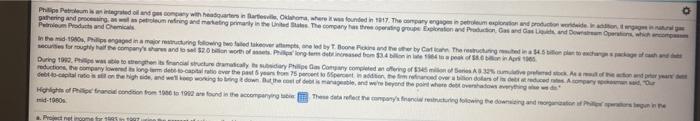

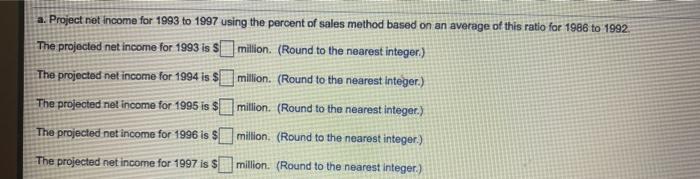

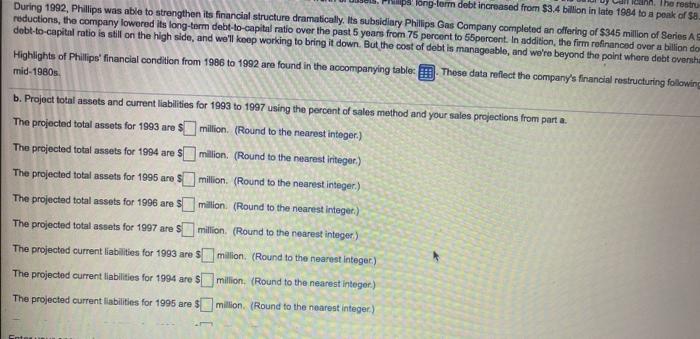

Gas and Gas Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Summary Financial Information for Phillips Petroleum Corporation: 1986 to 1992 (in Millions of Dollars Except for per Share Figures) 1986 1987 1988 1989 Sales $10,018 $10,917 $11,490 $12,492 Net income 228 35 650 219 EPS 0.89 0.06 2.72 0.90 Current assets 2,802 2,855 3,062 2,876 Total assets 12,403 12,111 11,968 11,256 Current liabilities 2,234 2,402 2,468 2,706 Long-term debt 8.175 7,887 7.387 6,418 Total liabilities 10,409 10.289 9,855 9,124 Preferred stock 270 205 0 0 Common equity 1,724 1,617 2,113 2 132 Dividends per share 2.02 1.73 1.34 0.00 Source: Phillips annual reports for 1986 to 1992 1990 $13,975 541 2.18 3,322 12,130 2,910 6,505 9,411 0 2,719 1.03 1991 $13,259 98 0.38 2.459 11,473 2,503 6,113 8.716 0 2,757 1.12 1992 $12,140 270 1.04 2,349 11.468 2,517 5,894 8,411 359 2,698 1.12 Print Done Philips Piems gedoen wory where in aree Oom, where was founded in 1917. The company ergonood production de paring and procesom refiring and marketing party in the The company stretnution and used as and we Perum Products and Chemicals the 90s, perodinamicturing og twee keer was led by Born and her by Cat Thange in the for muy the company and to 20 worth of Progressed on 3.4 of Art During 1999. Photos freshwater Phone og forsterken eductions, the company low long term cover the years from 75 percent percent of overdoso Gecapitare il conte Night and we working tong down the cost of us and we were the powered by Hei Piration from 1006 to 1992 round the These are consisting for the day and to me mid-1000 Preto a. Project net income for 1993 to 1997 using the percent of sales method based on an average of this ratio for 1986 to 1992 The projected net income for 1993 is | million (Round to the nearest integer.) The projected net income for 1994 is $ million. (Round to the nearest Integer.) The projected net income for 1995 is $ million. (Round to the nearest integer.) The projected net income for 1996 is $ million (Round to the nearest integer.) The projected net income for 1997 is s million. (Round to the nearest integer.) cunn. The restru long-term debt increased from $3.4 billion in late 1984 to a peak of $8. During 1992, Phillips was able to strengthen its financial structure dramatically. Its subsidiary Philips Gas Company completed an offering of $345 million of Series AS reductions, the company lowered its long-term debt-to-capital ratio over the past 5 years from 75 percent to 55percent. In addition, the firm rofinanced over a billion do debt-to-capital ratio is still on the high side, and we'll keep working to bring it down. But the cost of debt is manageable, and we're beyond the point where debt oversha Highlights of Phillips financial condition from 1996 to 1992 are found in the accompanying table. These data reflect the company's financial restructuring following mid-1980s b. Project total assets and current liabilities for 1993 to 1997 using the percent of sales method and your sales projections from porta. The projected total assets for 1993 are million (Round to the nearest integer.) The projected total assets for 1994 are $ million (Round to the nearest integer.) The projected total assets for 1995 are $ million (Round to the nearest Integer.) The projected total assets for 1996 are 5 million (Round to the nearest integer.) The projected total assets for 1997 are million (Round to the nearest integer) The projected current liabilities for 1993 are $ million. (Round to the nearest integer) The projected current liabilities for 1994 are S million (Round to the nearest integer.) The projected current liabilities for 1995 are 5 million (Round to the nearest integer) Highlights of Philips' financial condition from 1986 to 1992 are found in the accompanying table: These data mid-1980s. The projected current liabilities for 1995 are million. (Round to the nearest integer.) The projected current liabilities for 1996 are $ million. (Round to the nearest integer.) The projected current liabilities for 1997 are $ million. (Round to the nearest integer.) c. Assuming that common equity increases only as a result of the retention of earnings and holding long-term debt total assets and current liabilities vary as a percentage of sales as per your answers to part b. In addition, assume th The projected discretionary financing needed for 1993 is $ million. (Round to the nearest integer.) The projected discretionary financing needed for 1994 is $ million. (Round to the nearest integer.) The projected discretionary financing needed for 1995 is S million. (Round to the nearest integer.) The projected discretionary financing needed for 1996 is $ million (Round to the nearest integer.) The projected discretionary financing needed for 1997 is $ million. (Round to the nearest integer.) Enter your answer in each of the answer boxes. Save for Later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts